The IP Community Has an Ally in Neil Gorsuch!

Posted: 5/18/2020

U.S. Supreme Court Associate Justice Neil Gorsuch wrote the dissent in the Thryv, Inc. v. Clicl-to-Call, Tech, LP case that was recently decided by the U.S. Supreme Court. In the dissent, Justice Gorsuch provided a refreshingly compelling defense of patent rights, defending a patentee’s right to obtain judicial review of rulings from the Patent Trial and Appeal Board.

U.S. Supreme Court Associate Justice Neil Gorsuch wrote the dissent in the Thryv, Inc. v. Clicl-to-Call, Tech, LP case that was recently decided by the U.S. Supreme Court. In the dissent, Justice Gorsuch provided a refreshingly compelling defense of patent rights, defending a patentee’s right to obtain judicial review of rulings from the Patent Trial and Appeal Board.Justice Gorsuch was able to secure support for his view from just one other justice on the court, Associate Justice Sonia Sotomayer. What strikes us as most curious here is that a justice appointed by conservative Republican President Donald Trump joined forces with a justice appointed by liberal Democrat President Barack Obama on the issue of inventor rights!

For all the details about the court decision and some excellent analysis, please read “Justice Gorsuch Champions Patent Rights in Recent Dissent” that appeared in the April 22 IPWatchdog.

Why Put a Value on a Patent or Portfolio?

Posted: 5/18/2020

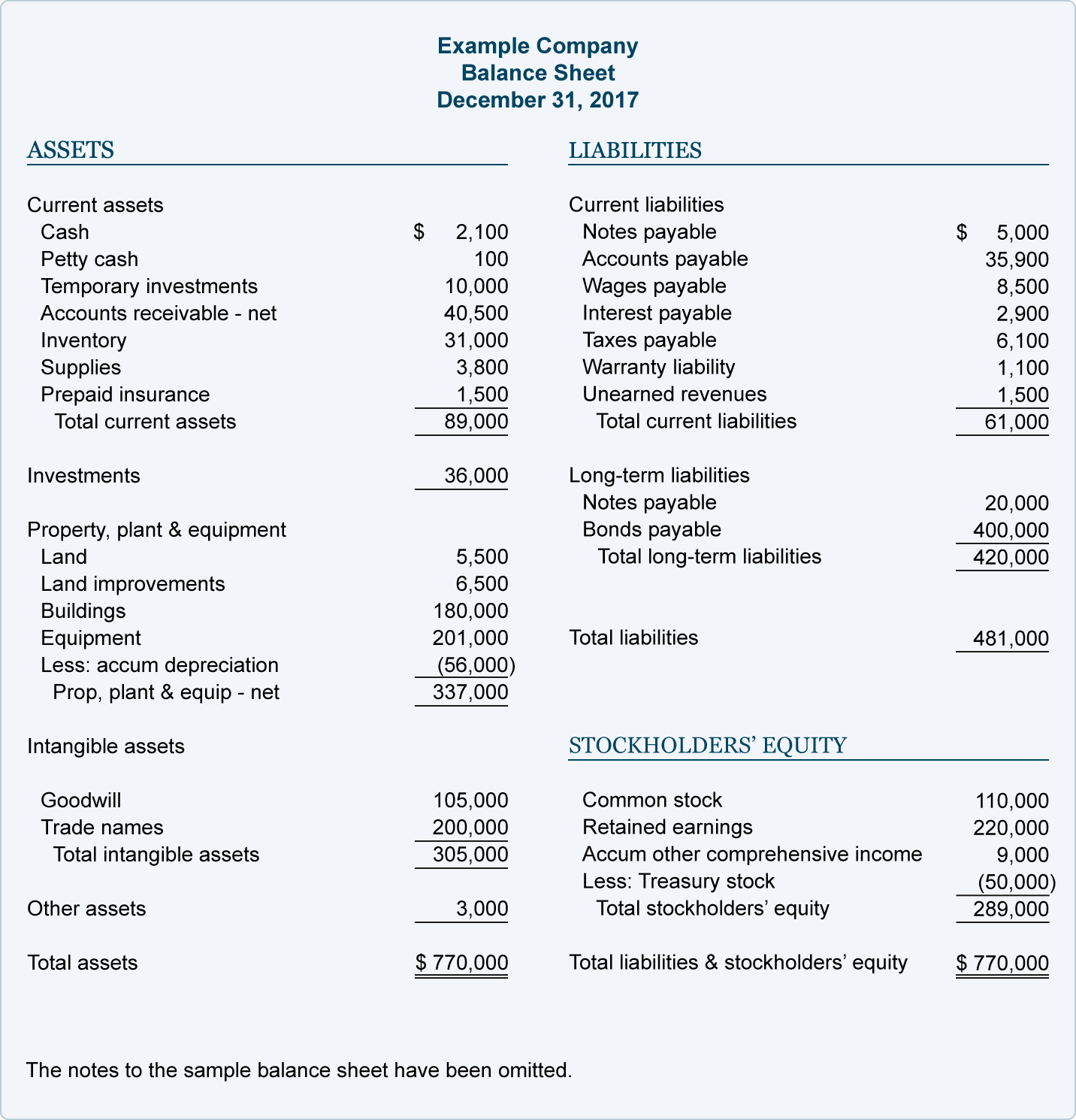

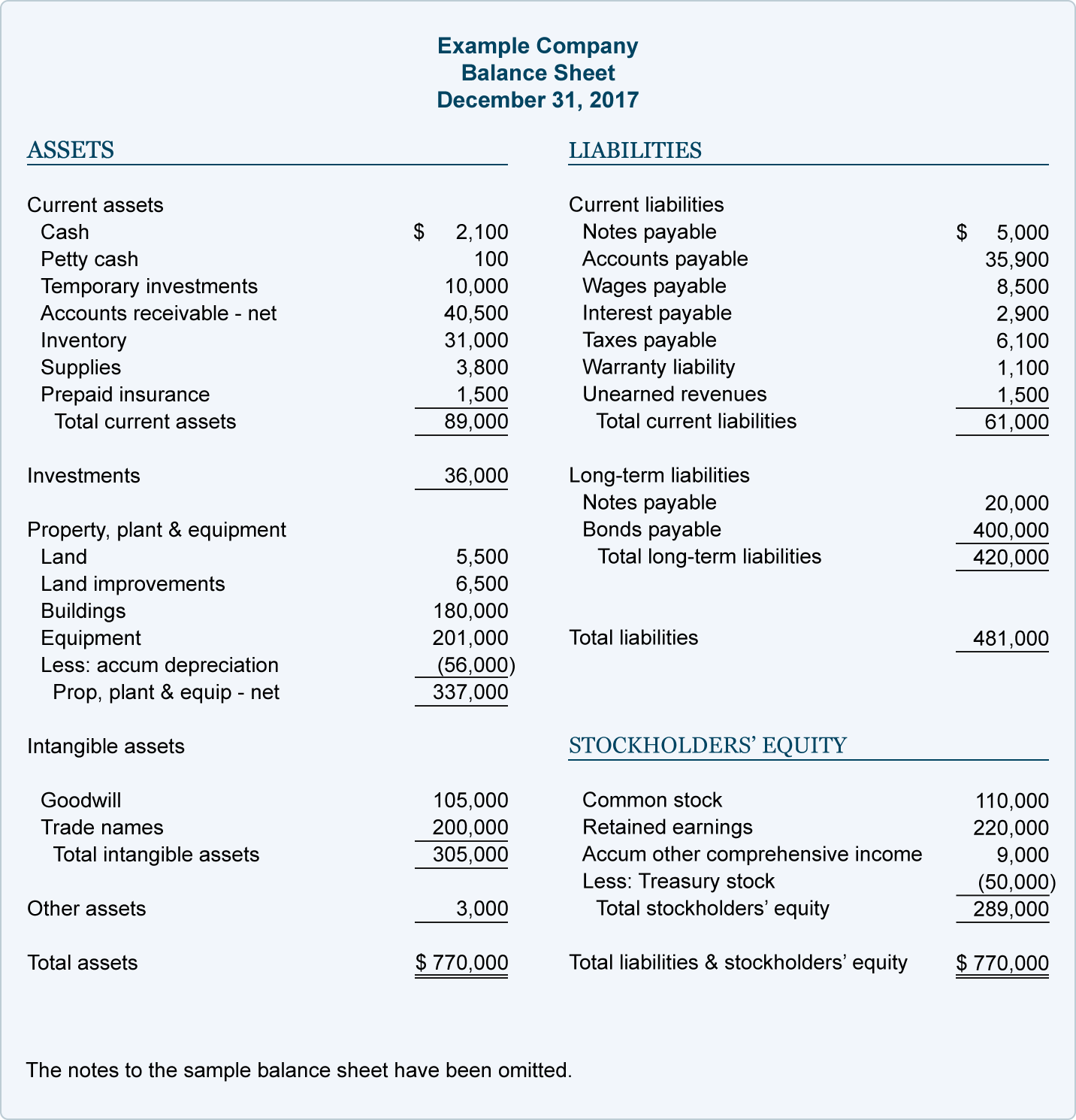

First of all, most patents that are assigned to businesses do not appear as an asset on the Balance Sheets of the companies that own them! Not surprisingly, many business owners and executives are shocked when they learn this. The reason is that patents do not come into existence as other corporate assets do.

First of all, most patents that are assigned to businesses do not appear as an asset on the Balance Sheets of the companies that own them! Not surprisingly, many business owners and executives are shocked when they learn this. The reason is that patents do not come into existence as other corporate assets do. A business buys a truck. The expenditure for the truck is an expense on the Profit-and-Loss Statement that becomes an asset on the company’s Balance Sheet. But when a company applies for a patent, the application and prosecution fees are written off as an expense in the years they are expended. When the patent is granted – two to three years later – no accounting transaction occurs like a check being issued to pay for the afore-referenced truck.

A beautiful patent with a gold crest and red ribbon arrives. It is either framed and hung on the wall or it is put in a file cabinet. What does NOT occur is any kind of accounting transaction that makes the patent appear as an asset on the company Balance Sheet.

In such cases, the company should have a Patent Valuation performed for all of its granted patents and then use those Valuations to document each patent’s value so they can be added to the Balance Sheet under Intangible Assets. This also applies to trademarks and service marks. Adding unrecorded patents to a business’s Balance Sheet can add hundreds of thousands – even millions – of dollars of new assets to a business’s net worth, dramatically improving a business’s debt-to-equity ratio. And that can both improve the ability of the business to secure financing and reduce the cost of borrowing! If it is a publicly traded company, it should have a positive effect on the stock price.

In such cases, the company should have a Patent Valuation performed for all of its granted patents and then use those Valuations to document each patent’s value so they can be added to the Balance Sheet under Intangible Assets. This also applies to trademarks and service marks. Adding unrecorded patents to a business’s Balance Sheet can add hundreds of thousands – even millions – of dollars of new assets to a business’s net worth, dramatically improving a business’s debt-to-equity ratio. And that can both improve the ability of the business to secure financing and reduce the cost of borrowing! If it is a publicly traded company, it should have a positive effect on the stock price. If you are an inventor with a patent or patents, you can have them appraised and list them as assets when, for example, you apply for a mortgage. Finally, if you are looking to sell or license your patent or portfolio, a professional valuation of your IP can give you an understanding of what it might sell for. Additionally, when a couple divorces, both may be required to report on their assets. We provided many valuations over the years for inventors in the midst of a split with their spouses. To learn more about the three Patent Valuation Services we offer, visit the Patent Valuation page at our website.

What Determines the Value of a National Patent?

Posted: 4/15/2020

So let’s back up and look at some hard numbers. The U.S. enjoys the largest economy in the world. In 2019, the United States – according to the IMF (International Monetary Fund) – generated just over $21 trillion in revenue. That’s $21 trillion in sales of goods and services – what the economists call GDP (Gross Domestic Product). The value of everything sold by all the businesses, not-for-profit organizations and government agencies in the U.S. – from automobiles to Alka Seltzer – food and drugs – clothing and toys – you name it. Every product and service including getting your teeth cleaned at the dentist and registering your car at Motor Vehicles.

Here is the list from the IMF of the countries in the world by their 2019 GDP that generated over $1 trillion in national revenue. This chart is in millions, so add six more zeros (“000,000”) at the end.

| United States | $21,439,453 |

|---|---|

| China | $14,140,163 |

| Japan | $5,154,475 |

| Germany | $3,863,344 |

| India | $2,935,570 |

| UK | $2,743,586 |

| France | $2,707,074 |

| Italy | $1,988,636 |

| Brazil | $1,847,020 |

| Canada | $1,730,914 |

| Russia | $1,637,892 |

| South Korea | $1,629,532 |

| Spain | $1,397,870 |

| Australia | $1,376,255 |

| Mexico | $1,274,175 |

| Indonesia | $1,111,713 |

What does this have to do with patents? Simply this: A U.S. Patent has considerable value simply because the U.S. is the largest economy with the largest potential for sales of a product based on that U.S. Patent. A U.S. Patent enables you to produce and sell a product in the largest economy in the world – and sue any business that infringes your patent for reasonable royalties and lost profits, seek injunctive relief, and generate negative press coverage for the infringer.

What does this have to do with patents? Simply this: A U.S. Patent has considerable value simply because the U.S. is the largest economy with the largest potential for sales of a product based on that U.S. Patent. A U.S. Patent enables you to produce and sell a product in the largest economy in the world – and sue any business that infringes your patent for reasonable royalties and lost profits, seek injunctive relief, and generate negative press coverage for the infringer. Following that thinking, a Greek Patent has relatively little value because it only gives you patent protection in a relatively small country that generated just $214 billion in national revenue and ranked No. 50 out of 186 countries. Any company anywhere in the world – except Greece – can manufacture a product that infringes your Greek Patent and sell that product anywhere in the world – except Greece – in blatant infringement of your Greek Patent. And you can do NOTHING about it!

Now it is possible that a company could infringe a U.S. Patent, but by manufacturing the product outside of the U.S. and purposely selling the product exclusively outside of the U.S. it would avoid being pursued by the U.S. Patent owner. Yes, this is possible, but it is not practical. The U.S. is one fourth of the global economy. Bypassing sales in the U.S. deprives the infringer of one-fourth of the sales it could generate had it purchased or licensed that U.S. Patent. But virtually any company can be very successful manufacturing and selling a product in 185 nations around the world, but not Greece.

Now it is possible that a company could infringe a U.S. Patent, but by manufacturing the product outside of the U.S. and purposely selling the product exclusively outside of the U.S. it would avoid being pursued by the U.S. Patent owner. Yes, this is possible, but it is not practical. The U.S. is one fourth of the global economy. Bypassing sales in the U.S. deprives the infringer of one-fourth of the sales it could generate had it purchased or licensed that U.S. Patent. But virtually any company can be very successful manufacturing and selling a product in 185 nations around the world, but not Greece.That is why we find ourselves telling owners of Portuguese and Peruvian and Phillipine Patents that their patents just simply do not have any commercial value. It makes more sense to infringe the patent and manufacture and sell a product based on that patent outside of the country where the patent was granted than to buy or license the patent in the first place.

This is not because we are a bunch of Ugly Americans. The Ugly American was a novel published in 1958 about America’s diplomatic failures in Southeast Asia. The title of the book came to be the term used to describe Americans who think the sun rises the sets on the U.S. to the exclusion of the rest of the world. Yes, the staff at IPOfferings are all Americans who love and are proud of our country, but the value we place on U.S. Patents versus patents from relatively small countries is not because we are blind to the rest of the world. It is a simple matter of economics and cold, hard numbers.

The lesson for all readers of this column is this: If you are applying for a U.S. Patent, consider also applying for a Chinese, Japanese and European Patent as it will give your patent significantly more economic value. Why do we recommend a Chinese, Japanese and European Patent instead of a Chinese, Japanese and German Patent? Because applying for a German Patent is about the same amount of work as applying for a European Patent, and with your European Patent Application you can specify three nations, so select Germany (the fourth largest economy), the UK (the sixth largest economy) and France (the seventh largest economy).

The lesson for all readers of this column is this: If you are applying for a U.S. Patent, consider also applying for a Chinese, Japanese and European Patent as it will give your patent significantly more economic value. Why do we recommend a Chinese, Japanese and European Patent instead of a Chinese, Japanese and German Patent? Because applying for a German Patent is about the same amount of work as applying for a European Patent, and with your European Patent Application you can specify three nations, so select Germany (the fourth largest economy), the UK (the sixth largest economy) and France (the seventh largest economy).If you are filing for a non-U.S. Patent, file a PCT Patent Application and use it to secure additional patents in countries with large economies. We have nothing against Turkey or Taiwan or Thailand, but they are just not large economies. A single patent from the UK or Canada or Australia – all companies in the Top 16 – still has limited value without a U.S. Patent to give the invention patent protection in the largest economy.

We live in a flat world. We are referring to the term created by Thomas Friedman in his 2005 best-seller, The World Is Flat. The book did not attempt to prove that Christopher Columbus was wrong and his ships would fall off the end, but that any business anywhere in the world can now compete with any other business anywhere in the world. Friedman’s reference to the world being “flat” was that today’s global economy is a level playing field. That also means that any company anywhere in the world can infringe your patent – and get away with it if you have not locked up patent protection in the larger economies. In securing patent protection for your invention, keep these critical numbers in mind and be smart about it.

Licensing versus Selling – and Licensing versus Buying – a Patent

Posted: 3/19/2020

Most companies prefer to own a patent. They prefer to pay cash, own the patent, and carry it on their books as an asset. They can practice the patent, and assert it against any and all infringers. They may have strategic partners to which they might license or cross-license the patent. But all things being equal, if they have the cash, businesses prefer to buy and own the patent.

If a company does not have the cash to buy a patent outright, it will consider licensing it. This applies to start-up businesses, or businesses that have faced a downturn and are looking at new technologies to make a turnaround. The problems with licensing a patent – especially if it is a non-exclusive license – is that the licensor can license the patent to all of the first licensee’s competitors, wiping out any competitive advantage that the first licensee had. When a company licenses a patent, there is also the issue of computing each quarter the sales that are subject to the royalty. For example, if it is a U.S. Patent, no royalty is due on export sales, so they have to be backed out in order to compute the royalties that are due.

If a company does not have the cash to buy a patent outright, it will consider licensing it. This applies to start-up businesses, or businesses that have faced a downturn and are looking at new technologies to make a turnaround. The problems with licensing a patent – especially if it is a non-exclusive license – is that the licensor can license the patent to all of the first licensee’s competitors, wiping out any competitive advantage that the first licensee had. When a company licenses a patent, there is also the issue of computing each quarter the sales that are subject to the royalty. For example, if it is a U.S. Patent, no royalty is due on export sales, so they have to be backed out in order to compute the royalties that are due. For the assignee, the problem with licensing is that the licensee may or may not be successful with a product line based on the licensed patent. If Company A licenses a patent, and then never generates any significant sales from products based on the licensed patent – for whatever reason – the licensor takes a hit. But if the product takes off, the licensor can do very well! Selling the patent is low risk/low return. Licensing the patent is high risk/high return.

There is also the issue of enforcement. If a patent is licensed, and the patent is infringed, the licensee often does not have standing to bring an action against the infringer, and the licensor – often an individual and the inventor – does not have the resources to pursue the infringer. So the licensee ends up with a competitor that is infringing the licensed patent and not paying a royalty.

There is also the issue of enforcement. If a patent is licensed, and the patent is infringed, the licensee often does not have standing to bring an action against the infringer, and the licensor – often an individual and the inventor – does not have the resources to pursue the infringer. So the licensee ends up with a competitor that is infringing the licensed patent and not paying a royalty.There is no simple response to the question of whether it is better to sell or license, or buy or license, a patent. There are a number of factors that have to be considered. That is why IPOffering always takes a broad “monetization” approach when we take on a patent as a brokerage project.

There is a very good book that covers patent licensing. “Essentials of Licensing Intellectual Property” is available at Amazon for about $25.00 and it covers most comprehensively what both a licensor and licensee needs to know.

If you are a business executive torn between buying or licensing a patent – or an inventor not sure about selling or licensing your patent – we can help you determine what the key factors are that need to be taken into consideration so you can make the best decision. Because, hey, that’s what we do!

Proposed Legislation Aims to Level the Playing Field

Posted: 2/19/2020

It is incredibly ironic that in the December and January installments of Patent Leather we were covering patent infringement, so we did not have room for this news until now. Last December, Rep. Danny Davis (a Democrat from Illinois) and Rep. Paul Gosar (a Republican from Arizona) introduced the Inventor Rights Act of 2019 (H.R.5748). The bill has five main elements and it only applies to inventors who own their own patents (many IPOfferings clients fall in that category) and not businesses, universities and NPEs (non-practicing entities). For a description of what an NPE is, refer to the January installment of Patent Leather below.

It is incredibly ironic that in the December and January installments of Patent Leather we were covering patent infringement, so we did not have room for this news until now. Last December, Rep. Danny Davis (a Democrat from Illinois) and Rep. Paul Gosar (a Republican from Arizona) introduced the Inventor Rights Act of 2019 (H.R.5748). The bill has five main elements and it only applies to inventors who own their own patents (many IPOfferings clients fall in that category) and not businesses, universities and NPEs (non-practicing entities). For a description of what an NPE is, refer to the January installment of Patent Leather below.- IPR Opt-Out: The bill would give inventors the right to opt out of an inter partes review of their patentsby the Patent Trial and Appeal Board (PTAB). Accused infringers (plaintiffs in a patent infringement lawsuit) will still have the right to challenge the validity of a patent in U.S. District Court as part of an infringement lawsuit trial, but they will not have the second-bite-of-the-apple they now have to also force a patent into review by the PTAB. A common strategy of infringers is to get a patent it has been charged with infringing invalidated so it simply goes away, and that second option would no longer exist if the bill were passed.

- Profits from the Infringer: Under current law, inventors are only entitled to receive reasonable royalties (also refer to the January installment of Patent Leather for more information on this) from an infringer, permitting the infringer to keep most of their profits generating by the infringing products it has sold and continues to sell. This bill pays all profits generated by willful infringers who knew or should have known of their infringement of a patent owned by the original inventor to the original inventor. This remedy is consistent, incidentally, with other forms of intellectual property including design patents, copyrights and trademarks.

- Injunctive Relief: This bill would also entitle an inventor to an injunction prohibiting sales of infringing products, a remedy-at-law no longer available to inventors since the 2006 eBay Decision (additional information on the eBay Decision is included in the January Patent Leather installment).

- Venue Preference: The bill gives inventors the right to file patent infringement litigation in their home judicial districts. They are currently required to sue an infringer in a district in which the infringer has a facility, and that could be the other end of the country, adding additional costs and burdens for the inventor.

- Fee Recovery: Inventors – under this bill – would be entitled to recover from the defendant (infringer) their attorney fees if they exceed more than 10% of the amount of damages awarded to the plaintiff.

We suggest you send an email to your U.S. Representative expressing your support for H.R.5748. Let’s see what happens.

What You Probably Did Not Know about Patent Rights

Posted: 2/19/2020

When one of us speaks at a conference or other event, we like to work in whenever appropriate that the right to patent an invention or copyright a document actually predates such other established American concepts as Freedom of the Press, Due Process and Habeas Corpus. And here is why…

When one of us speaks at a conference or other event, we like to work in whenever appropriate that the right to patent an invention or copyright a document actually predates such other established American concepts as Freedom of the Press, Due Process and Habeas Corpus. And here is why…The First Constitutional Convention met in Philadelphia in 1787 and hammered out what is the original U.S. Constitution. By “original” we mean the U.S. Constitution without any amendments. In December of 1787, Delaware was the first state to ratify the Constitution. That is why “The First State” appears on Delaware license plates. In 1788 Rhode Island rejected the Constitution, but later that year New Hampshire became the ninth state to ratify the Constitution, the number needed to put it into effect. Eventually all the other states also ratified it.

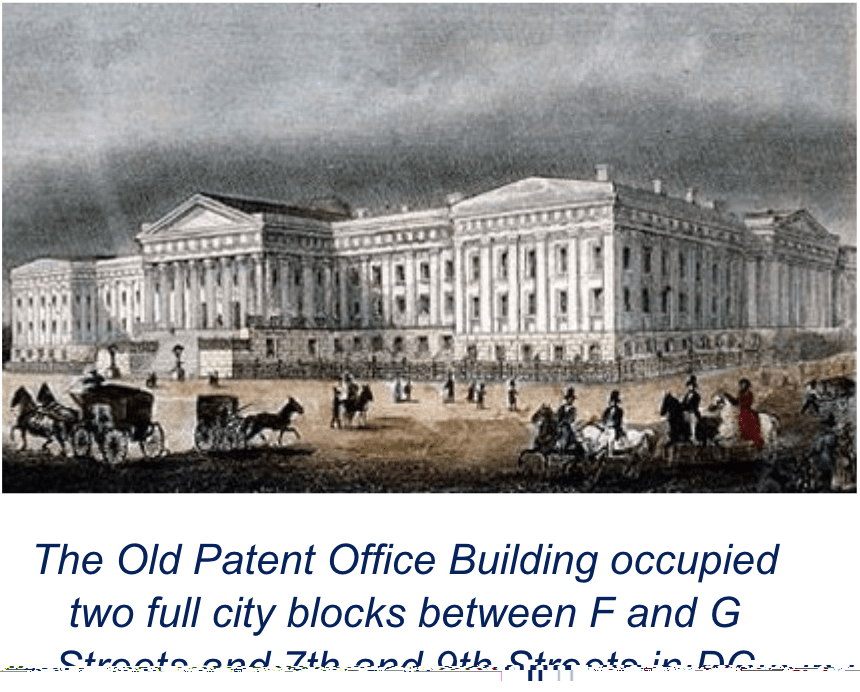

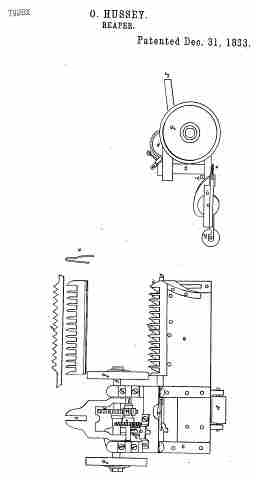

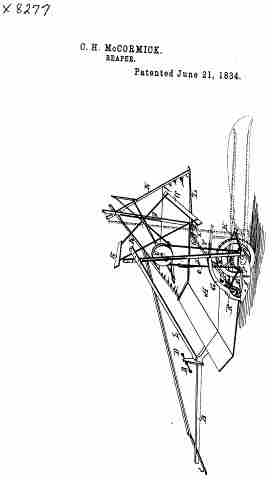

Article 1, Section 8, Clause 8 of the original U.S. Constitution gives Congress the power “To promote the Progress of Science and useful Arts, by securing for limited Times to Authors and Inventors the exclusive Right to their respective Writings and Discoveries." It is from this section of the original U.S. Constitution that all Patent and Copyright – and later Trademark and Service Mark – laws were derived. So U.S. citizens had the constitutional right to seek protection for their inventions in the form of a patent beginning in 1788, the year the original U.S. Constitution was ratified.

The next year, 1789, Congress drew up twelve proposed Amendments to the Constitution and circulated them to the states for ratification. It was these Amendments – not the original Constitution – that included Freedom of Speech, Freedom of Assembly, the right to bear arms, protection from unreasonable search and seizure, Due Process, Habeas Corpus and the many other rights we enjoy as Americans. Ten of the twelve proposed Amendments - known today as the "Bill of Rights" - were not ratified until 1791, three years after the original U.S. Constitution was ratified.

And that is why patent rights in the U.S. predate the many rights that Americans enjoy and that are considered essential to the country we are. In fact, many historians and economists believe that the incredible prosperity, wealth formation and technological superiority that America enjoys is due in large part to our patent system – a brainchild of our Founding Fathers.

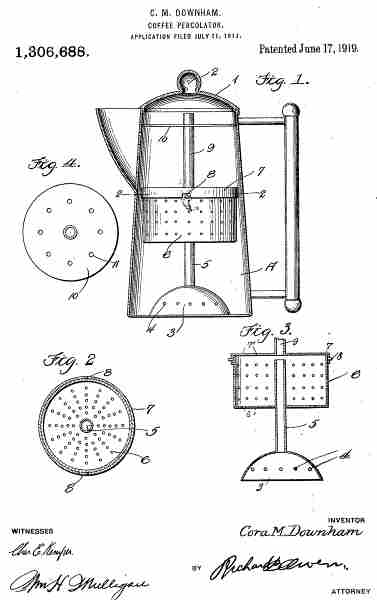

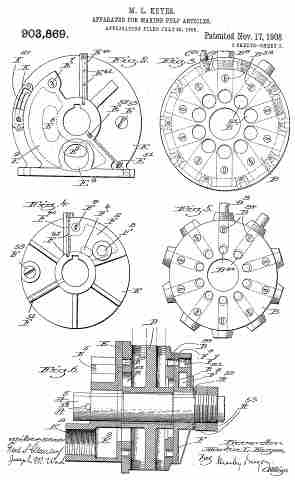

The first U.S. Patent was granted in 1790 to one Samuel Hopkins of Massachusetts for a process for making potash. The Patent Examiner was Secretary of State Thomas Jefferson and the patent was signed by President George Washington.

Even More Answers to Your Questions about Patent Infringement

Posted: 1/20/2020

Q: Can I get the court to order an infringer to stop selling products that infringe my patent?

A: Maybe. It depends on what class of patent holder you fall into. Class? Yes, class. There are, in fact, two distinct classes of patent holders, and the remedies available to you as a patent holder when your patent is infringed depends on what class you are in.

◆ NPE: An NPE (non-practicing entity) is a patent hold that does not “practice” his or her or its patent. Most universities own patents that were developed by their faculties, but we know of no university that has a factory on campus that manufactures products based on one of the university’s patents. Most universities have a Tech Transfer department that licenses the university’s patents to industry. So universities are NPEs.

An inventor who does not make a product based on his or her patent is also an NPE.

There are businesses that own patents they do not practice. The R&D staff comes up with a great idea, so the company applies for a patent. Smart move. But Marketing decides there is no market for a product based on that patent, or such a product is not a good fit with the company’s other products, or the product is not core to the company’s business model, or for some other reason decides to not practice a patent owned by the company. Many such companies come to IPOfferings to represent them in the monetization of their “non-core” patents. A company that owns a patent it does not practice is an NPE.

And then, of course, there are patent assertion firms that acquire infringed patents specifically to assert them against the infringer(s), so patent assertion firms are NPEs.

◆ Market Participant: The opposite of an NPE is a “Market Participant.” A Market Participant is almost always a business, and the business owns a patent or several patents that it “practices” – it makes and/or sells a product or service that uses the invention covered by one or more of the patents owned by that business.

The remedies available to an NPE are much different than those available to a Market Participant. When an NPE sues a company for infringing its patent, it has just one remedy available to it under law – reasonable royalties. It can demand that the infringer pay the patent holder what the infringer would have paid the patent holder had the infringer licensed the patent in the first place. If the patent holder can prove that the infringement was willful – the infringer knew about the patent but when ahead and infringed it anyway – the patent holder can sue for treble damages. But the only remedy-at-law available to an NPE is the royalties that would have been paid by the infringer had the infringer properly licensed the patent in the first place.

A Market Participant, however, has three remedies available to it. It can demand reasonable royalties from the infringer just as the NPE can. And it can sue for treble damages if it can prove the infringement was willful.

The Market Participant can also sue for lost profits. By selling products that infringe the Market Participant’s patent, the infringer essentially stole business from the Market Participant since customers would have purchased the Market Participant’s products had the infringer not been selling infringed products that directly competed with the Market Participant’s products. So the Market Participant can estimate what the sales of its products would have been had the infringer not been selling directly competing products, and the Market Participant can sue the infringer for the profits it would have generated on those sales.

The third remedy-at-law available to a Market Participant – and not an NPE – is “injunctive relief” – a court order that bars the infringer from continuing to sell the infringing product. In what is known as the “eBay Decision” the U.S. Supreme Court ruled that an injunction blocking an infringer from selling infringing products should not automatically be issued to all patent holders. It created a four-factor test that the courts must apply. We will not go into all the details, but the primary result of the eBay Decision is that NPEs routinely do NOT receive injunctive relief, but it is granted to Market Participants.

When Apple sued Samsung back in 2010 in the “patent infringement lawsuit of the century,” Apple asked for an injunction barring Samsung from importing into the U.S. and selling the Galaxy smartphones that infringed the Apple patent. The District Court judge did not grant the injunction. Apple appealed the decision, and the appellate court ruled that the District Court should have issued an injunction an injunction that barred Samsung from importing and selling infringing products. It was a Pyrrhic victory for Apple, however, because by the time the appellate court made its ruling, Samsung had moved on to a new model of smart phone and it was no longer selling the model that infringed the Apple patent.

So the answer to the question about getting the court to order the infringer to cease sales of the infringing product is that if you are an NPE, seeking a court order to bar sales of infringing products is not a practical objective for you to pursue. However, if you are a Market Participant, you can pursue injunctive relief as a remedy for infringement of your patent.

For those of you who are interested, the official title of the eBay Decision is “eBay Inc. v. MercExchange, L.L.C., 547 U.S. 388 (2006)” and Wikipedia has a well written article on the decision if you want to learn more.

Q: What is the difference between a patent and a trade secret? Can you sue for infringement of a trade secret?

A: A “patent” is a bargain with the U.S. Federal Government under which in exchange for disclosure of your patent the federal government grants you a 20-year monopoly. You have the exclusive right to manufacture and sell a product based on the invention covered by your patent for 20 years from the Application Date of the patent. Or you can license that right to someone else, or you can sell the patent, and the new owner (or “assignee”) of the patent now has the same rights granted to the applicant. And you have the right to sue any person or business that infringes your patent.

A “trade secret” is first and foremost a “secret.” You file no application and you share the invention with no one. It is your little secret. And it is your trade secret for as long as you can keep it a secret. One of the most famous trade secrets is the formula for Coca-Cola. John Pemberton made the critical decision in 1886 to NOT file for a patent on the formula, but to keep it as a trade secret. It remains a trade secret to this day. The formula for Coca-Cola – as legend goes – is safely locked in an Atlanta bank safety deposit box, and only a few long-term and highly trusted (and, we assume, well paid) Coca-Cola employees know the formula. Had Pemberton secured a patent for the Coca-Cola formula, that patent would have expired over 100 years ago.

A trade secret is not a practical strategy for a device or tool or other physical product because it can be reverse-engineered by a competitor who could then make a directly competing product. So a process or formula used to produce a product is a far more reasonable candidate to be treated as a trade secret.

If a trade secret is stolen from you – and you can prove it – you do not sue for infringement (that only applies to patents and trademarks), you actually charge the party that stole your trade secret with theft. Many states have laws that specifically cover theft of trade secrets.

Companies that have trade secrets must go to extraordinary lengths to protect them. Only a small number of trusted employees can know about the technology, and access to facilities that use the trade secret should be very limited.

Answers to Your Questions about Patent Infringement

Posted: 12/11/2019

Q: Is there ever a time you would NOT pursue an infringer of your patent?

A: Most definitely! Asserting your patent against an infringer needs to be more about money than justice. Whether you engage a patent litigation law firm and pay your own legal expenses, or you partner with a patent assertion firm to pursue the infringer, the cost will be substantial. It currently costs at least $200,000 – and that number can go to $300,000 or $400,000 or even higher based on several factors – to file and try a patent infringement lawsuit. We will not detail all the costs, but the expert witnesses, consultants, depositions, filings, hearings, motions and a dozen other elements to a patent infringement lawsuit all add up pretty quickly.

If the defendant is found to be infringing your patent, the law permits you to receive “reasonable royalties.” That is, if the infringer had licensed your patent in the first place, what royalty would the company have paid you? Royalties typically run a quarter or half percent of sales – maybe one percent of sales.

So if the infringer has sold $5 million worth of infringing products, and you claim a 1% royalty, that’s $50,000. You do not need a degree in Accounting to see that it is not worth spending $200,000 to sue an infringer for $50,000. If the patent is new, and it has ten or more years to run, and the infringer will be generating another $20 million in sales of infringing products, 1% of $25 million is still only $250,000, making a patent assertion campaign an essentially break-even venture.

So the answer is that it is NOT financially viable to sue an infringer unless the company has generated – or will generate over the remaining lifetime of the patent – at least $50 million or more in sales.

Q: Why not just notify the infringer that it is infringing my patent and ask them to pay a royalty?

A: Bad Idea! In fact, really bad idea. Never, ever notify a company that you believe that it is infringing your patent. The infringer will likely file a Summary Judgement action against you, making you the defendant in an expensive lawsuit with no good outcome. Either engage a patent litigator or partner with a patent assertion firm. NEVER contact the infringer directly!

Q: When I sue for infringement, what about the use of my patent for its remaining years?

A: Good question! Let’s say a company has been infringing your patent for the last five years, and your patent has 10 years left to run. You can only sue for the infringement that has occurred, so if you win your case or reach a settlement with the infringer, you are entitled to reasonable royalties for the period of infringement. Going forward, there are two likely outcomes. Either the infringer will take a license and pay you a royalty on sales of its products that use your patent for the remaining life of the patent, or it will negotiate a lump sum forward settlement. The company will estimate what sales will be of the infringing product(s) over the remaining life of the patent and pay you a lump sum for a lifetime license to your patent. This has become the more common outcome since it is cleaner and neater than having to compute the royalties due and cut a royalty check every three months.

Q: Do I want a trial?

A: NO! You could go to trial and win, but you could also go to trial and lose. It is hard to predict what a jury will do. When Apple sued Samsung for patent infringement back in 2010, Apple wanted a trial for the public relations benefit. Your objective should be to walk away with some cash. Additionally, even if you go to trial and win, the infringer could file appeals that could drag on for years – and double or triple your legal expenses. The most desirable outcome is an out-of-court settlement with the infringer as it is a final agreement between the parties.

Q: Couldn’t I represent myself?

A: Never a good idea! Representing yourself in Small Claims court or local traffic court is one thing. Patent litigation is very sophisticated, very complex. Trying your own patent infringement lawsuit is the equivalent of do-it-yourself dentistry. We recommend seeing Flash of Genius. It is about Robert Kearns, the man who invented intermittent windshield wipers. He showed his invention to the major car companies, they all infringed his patent, and Kearns sued them himself for patent infringement. It quite literally ruined his life!

So You Think Your Patent Is Infringed. Part Two

Posted: 11/20/2019

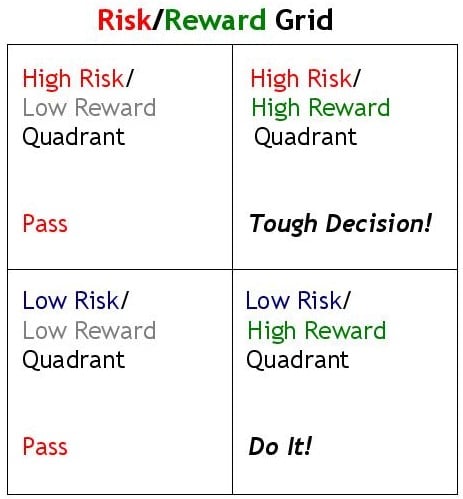

Once you’ve determined that your patent (or patents) is infringed, and you’ve developed Claim Charts, you have two broad options ahead of you – the Low Risk/Low Reward Option or the High Risk/High Reward Option. Here is how they break out.

Once you’ve determined that your patent (or patents) is infringed, and you’ve developed Claim Charts, you have two broad options ahead of you – the Low Risk/Low Reward Option or the High Risk/High Reward Option. Here is how they break out.Low Risk/Low Reward Option: There are companies that buy patents for enforcement, then retain the services of a patent litigator to pursue the infringer(s). These companies buy the patent for cash. While the sales price will be modest, it is cash and there is NO risk to you. There is a second Low Risk/Low Reward option – sell the patent to the infringer. Companies will often buy a patent to eliminate it as a litigation liability. Again, the sales price will be modest, but there is virtually no risk to you.

High Risk/High Reward Option: Asserting your patent against the infringer or infringers creates the opportunity for a significant payoff, but it also creates several risks that you need to be aware of. IPOfferings has relationships with all the major Patent Assertion Firms. These are businesses that specialize in asserting patents against infringers on behalf of the patent owner. The typical arrangement is that the Patent Assertion Firm works on contingency. They cover all disbursements (filing fees, depositions, consultants, expert witnesses, due diligence, demonstratives, etc.) and legal fees. When they secure a settlement – this is critical – the Patent Assertion Firm splits the net settlement (gross settlement less expenses) with the patentee per an agreed-to formula. An out-of-court settlement is a final and binding agreement between the parties, so this is the most desirable outcome.

The key objective for the Patent Assertion Firm and its legal team is to present such a powerful claim that the infringer (the defendant in the lawsuit) decides it is better off settling out of court rather than taking the risk of going to trial. If the Patent Assertion Firm is forced to go to trial, you could win. But you could also lose. Game over. That is just one of several risks. Even if the Patent Assertion Firm is forced to go to trial and you win, the defendant will likely file an appeal – or several appeals – that could drag on for years.

The other risk to litigating your patent is that the infringer will almost certainly attempt to force your patent into reexamination in an attempt to have it invalidated. That means you could not just lose the lawsuit, you add the additional risk that you could actually lose your patent!

The reward, however, can be substantial. It is not uncommon for patent holders to win multi-million dollar settlements from multiple infringers!

So if you have a patent (or patents) that you believe have been infringed, IPOfferings can guide you through the process of making the best decision how to monetize them. For additional information about what to do if you believe your patent has been infringed, visit the Patent Infringement page at our website or download our Patent Infringement Services data sheet.

So You Think Your Patent Is Infringed. Now What?

Posted: 10/22/2019

First of all, a patent does not infringe another patent. Only a product or service infringes a patent. If you believe you have a patent, and a newer patent covers the same invention as your patent, there is an action you can take, but that will be covered in another article.

For a product or service to infringe your patent, the infringing product must “read” on all aspects of at least one of the independent claims in the patent. If Claim 1 calls for A, B, C and D, and a product has A, C and D, it is not infringing the patent. By “read” we mean that what the product does must be described in words (i.e., “read”) very similar to the words used in the patent.

If you believe your patent has been infringed, you need to have a qualified third party look at your infringement claim and develop what is called a “Claim Chart.” A Claim Chart is a two-column document in which the claim from the patent appears on the left, and directly across from it appears evidence of infringement, usually in the form of images and copy from the website of the manufacturer of the infringing product along with a link to the page from which the infringement “smoking gun” was taken.

We like to use the over-simplified example of the toaster oven. There are lots of toaster oven patents and lots of toaster ovens, but your toaster oven patent for the purpose of our illustration this month has two unique features: It includes a timer set by the user that turns off after X minutes, and it is a self-cleaning toaster oven with a super-high temperature setting that incinerates whatever is spilled in, or splattered on the walls of, the toaster oven.

We like to use the over-simplified example of the toaster oven. There are lots of toaster oven patents and lots of toaster ovens, but your toaster oven patent for the purpose of our illustration this month has two unique features: It includes a timer set by the user that turns off after X minutes, and it is a self-cleaning toaster oven with a super-high temperature setting that incinerates whatever is spilled in, or splattered on the walls of, the toaster oven.For a Claim Chart for this patent, in the left column is the exact wording from the claim that describes the timer. “Toaster oven includes electronic timer that is set by user and turns off automatically at user-set interval.” On the right side is a screen shot from a manufacturer’s website (with a link to that web page) showing the toaster oven with descriptive copy. “Thanks to its handy timer, just walk away and never worry about your food burning.” That descriptive copy “reads” on the text in the patent’s claim that covers the timer.

On the next page is the text from the claim in the patent that covers its high-temperature setting that cleans the toaster oven. “Toaster oven has 900ᵒ (F) setting that cleans oven by incinerating any food debris in oven.” On the right side is another screenshot (with a link to that web page) showing the toaster oven with copy next to it. “Just set the toaster oven to Self-Clean and it cleans itself automatically in about a half-hour.” That descriptive copy “reads” on the claim in the patent.

It is important to remember what we wrote back in the third paragraph. To infringe a patent, a product must read on all aspects of at least one claim in the patent. If the timer and self-cleaning setting are included in one claim, and the product only includes one feature, it is not infringing the patent. However, if the timer is in one claim, and the self-cleaning feature is in another claim, a toaster over with just the timer is infringing the patent.

You can make claims of infringement, and you can send emails and letters and make phone calls. But no one will take seriously your claim of infringement until you produce professionally prepared Claim Charts! IPOfferings provides this service. We also provide an Initial Infringement Analysis if you are not sure exactly what products are infringing your patent. For more information, visit the Patent Infringement page at our website. At that page, we show one of the Claim Charts used in the patent trial of the century – the Apple vs. Samsung iPhone patent infringement lawsuit from 2012.

Next month: You have Clam Charts. Now what are your options?

Are All of Your Assets Accounted for on Your Balance Sheet?

Posted: 9/17/2019

There is, however, one important class of asset that often falls through the cracks. One of your employees – in R&D or Engineering or Manufacturing or Marketing or any other department in the company – comes up with an idea for a new product. You decide to file for a patent to protect your invention. Good idea. You engage a patent attorney who files the patent application and manages the prosecution of the patent application.

There is, however, one important class of asset that often falls through the cracks. One of your employees – in R&D or Engineering or Manufacturing or Marketing or any other department in the company – comes up with an idea for a new product. You decide to file for a patent to protect your invention. Good idea. You engage a patent attorney who files the patent application and manages the prosecution of the patent application. The employee or employees who made the invention receive their salaries, and they are accounted for by your accounting system. The patent attorney bills out his or her services and is paid. And that expense is accounted for by your accounting system. So far, everything is working fine.

About two years after you file the patent application – current patent pendency at the U.S. Patent and Trademark Office is about 25 months – your application is approved and a patent is granted. And the handsome hard copy U.S. Patent with the red ribbon on it arrives at your business. Some businesses frame them and hang them on the wall. Other businesses just put them in a file folder. Some businesses have an IP page at their website, so they add the patent to the company’s list of patents at the website. And this is all fine.

But what virtually NO company does is perform an accounting transaction. Despite the fact that your company has a new asset – one that could be of considerable value – no change occurs to your company’s Balance Sheet because no other accounting transaction – like issuing an invoice or cutting a check – has occurred.

When a company buys a patent, the purchase is an accounting transaction, so the acquired patent or patents appear on the Balance Sheet under Intangible Assets. But the home-grown patents – patents the company applied for and received – do not trigger an accounting action that makes the patent an asset on the company’s Balance Sheet.

When a company buys a patent, the purchase is an accounting transaction, so the acquired patent or patents appear on the Balance Sheet under Intangible Assets. But the home-grown patents – patents the company applied for and received – do not trigger an accounting action that makes the patent an asset on the company’s Balance Sheet.For a public company, home-grown patents are assets that do not appear on the Balance Sheet, so they are not, therefore, included in the computation of the value of the business and not reflected in the company’s stock price. For a private business, home-grown patents are assets that do not appear on the Balance Sheet, so they are not, therefore, assets that can be used to secure loans, limiting the ability of the business to generate the working capital it needs.

Every business with a significant patent portfolio should have a professional valuation done every few years or so to determine the fair market value of those intellectual assets. Once the value of those assets has been determined through a third-party valuation, there is a process (consult with your CPA or auding firm) for adding those assets to your Balance Sheet. Only then will your business’s Balance Sheet – be it a public or private company – truly reflect all of the assets of the business enterprise.

In addition to patents, make sure that your Balance Sheet also includes the fair market value of your company's trademarks, service marks and copyrights, and any proprietary technology and know-how your company owns and uses.

Fortunately, securing a professional valuation of your company's patent(s) is right at your fingertips. IPOfferings provides three separate Patent Valuation Services.

► Basic Patent Valuation: This service covers six key metrics and is for internal pricing consideration.

► Enhanced Patent Valaution: This service would be used to value unrecorded patents and covers 12 key metrics.

► Comprehensive Patent Valuation: This service is used to value a patent family (a U.S. Patent that has associated foreign patents or applications) or a portfolio, it covers 18 key metrics, and it includes recommendations for increasing the value of the IP.

Just click here to visit the Patent Valuation Services page at our website. At that page, you can download the Data Sheet on our Patent Valuation Services.

Seat Belts and Air Bars Have Actually Been Around for a While

Posted: 8/19/2019

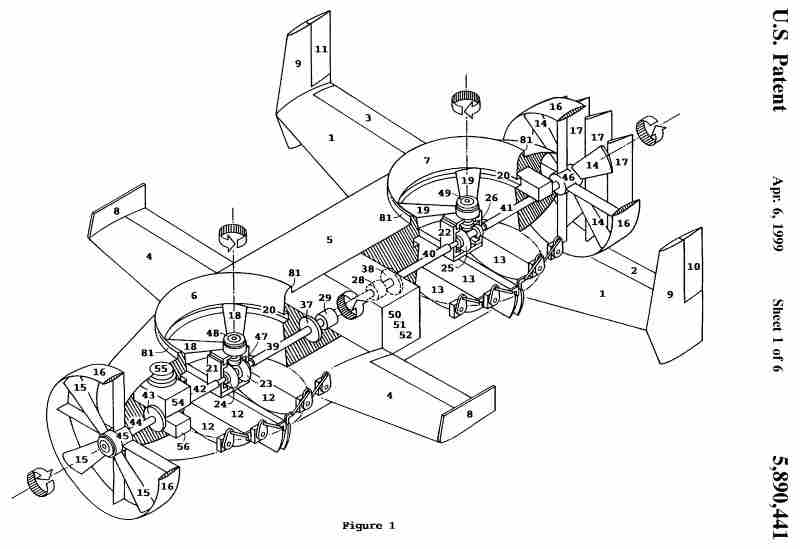

Those of us with a few years behind us think of seat belts and air bags as fairly recent auto safety developments, and they are, but the concepts for both go back quite a ways.

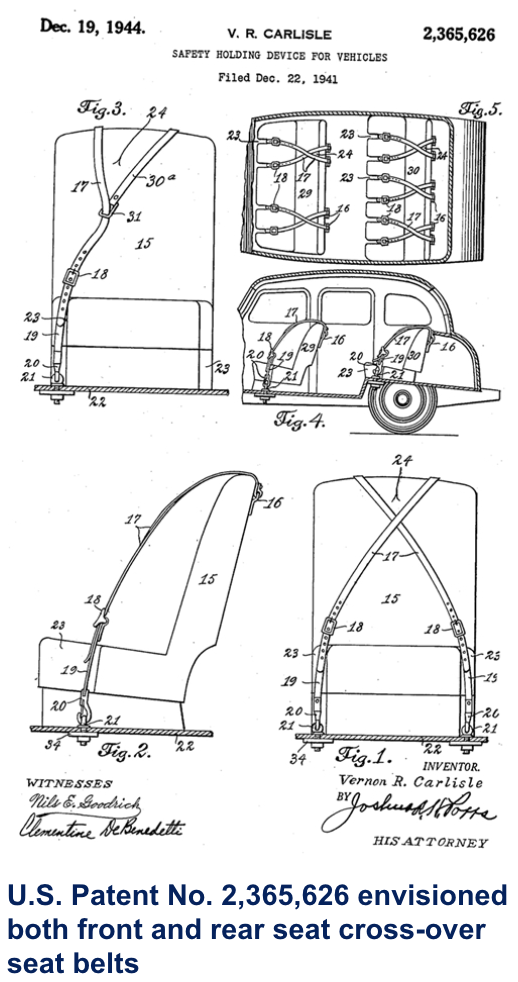

Those of us with a few years behind us think of seat belts and air bags as fairly recent auto safety developments, and they are, but the concepts for both go back quite a ways.Vernon Carlisle received U.S. Patent No. 2,365,626 in 1944 for a “Safety Holding Device for Automobiles.” It appears to be the first U.S. Patent for what we today call a “seat belt.” It was a double-strap cross-over seat belt like flight attendants use. What we find interesting is that in 1944 the entire U.S. automobile industry had been turned over to war production. The Chevrolet plant in Detroit was cranking out fighter planes 24/7. You could not buy a new car, but Mr. Carlisle was obviously thinking of the future. He filed for the patent in 1941 (just a week after the attack on Pearl Harbor), so patent pendency was about three years at that time.

The Nash Ambassador and Statesman models introduced seat belts to the American public way back in 1950. As one of the smaller car companies – Nash merged with Hudson to form American Motors – the company was looking for a competitive edge to set it apart. The only American Motors nameplate that survives today is the Jeep.

Seat belts became mandatory in 1968, and in 1974 the federal government upped the ante. You could not start the car until you latched your belt! There was so much resistance from the public that today we just have an annoying buzzer when we don’t buckle up.

We find no record of Mr. Carlisle ever commercializing his patent. That is not to say that he did not, we just do not find any press or other coverage indicating that he did.

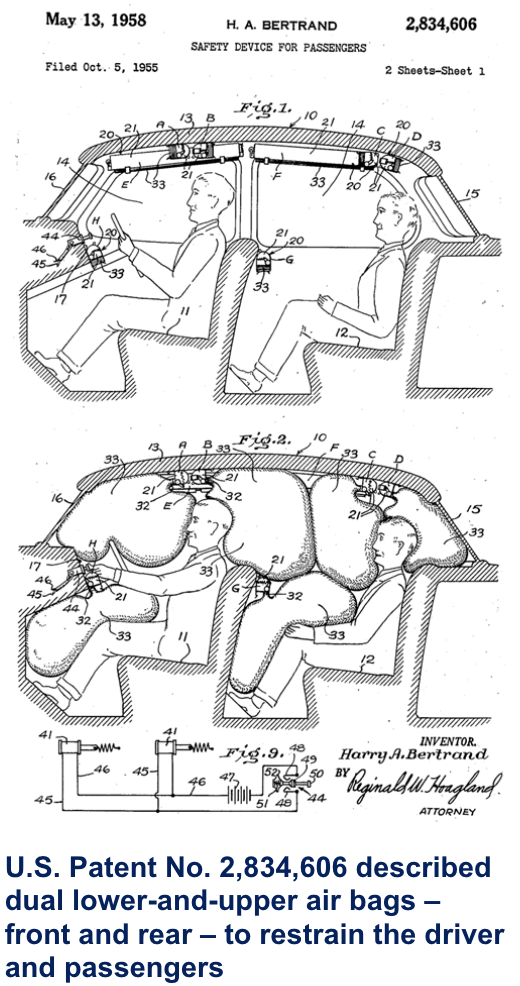

The second significant advancement in auto safety, air bags, goes back to 1958 when Harry Bertrand received U.S. Patent No. 2,834,606 for a “Safety Device for Passengers.” He filed for the patent in 1955, so the Patent Office was still running about a three-year pendency for patent applications. It was the forerunner of the modern air bag of today. The patent has 217 Forward Citations.

The second significant advancement in auto safety, air bags, goes back to 1958 when Harry Bertrand received U.S. Patent No. 2,834,606 for a “Safety Device for Passengers.” He filed for the patent in 1955, so the Patent Office was still running about a three-year pendency for patent applications. It was the forerunner of the modern air bag of today. The patent has 217 Forward Citations. Air bags caught on slowly. Ford experimented with air bags in some vehicles beginning in 1971. The 1973 Oldsmobile Toronado offered both driver side and passenger side air bags. As one of the first front-wheel-drive vehicles, the Toronado was GM’s test vehicle for new technologies.

GM featured airbags on its full-size 1975 Buicks and Oldsmobiles, and added air bags to the Cadillac line in 1976. During the Lee Iacocca years at Chrysler, the company was looking for a competitive edge – just as Nash was 40 years earlier – so it introduced airbags as standard equipment on all its 1988 models! It was not until 1998 that air bags were made mandatory.

And we also find no evidence – he may have, and we hope he did – that Mr. Carlisle every licensed his air bag patent.

There's the Light Bulb Patent, Telephone Patent and Airplane Patent. Did You Know There Was an Automobile Patent?

Posted: 7/22/2019

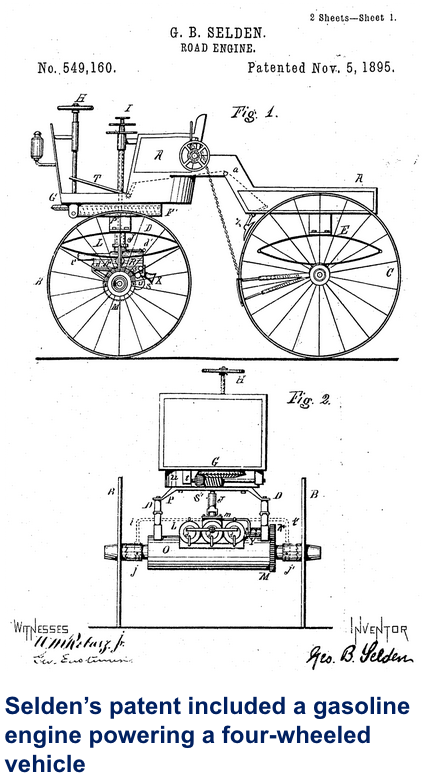

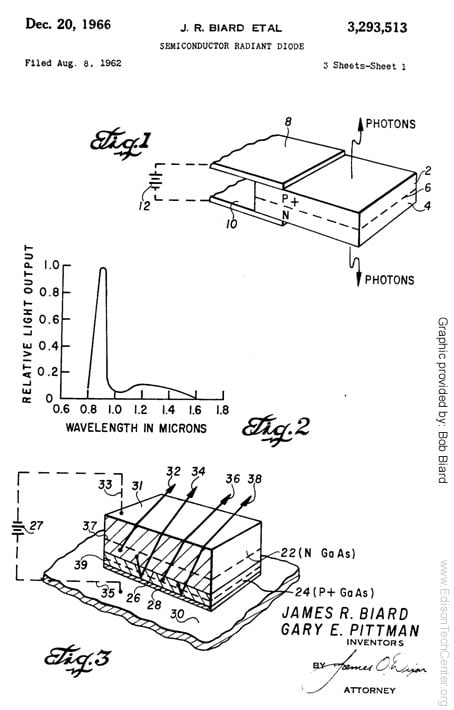

Yes, Virginia, there actually is an automobile patent – actually the automobile patent. George B. Selden of Clarkson, New York (near Rochester) was granted U.S. Patent No. 549,160 for a “Road Engine” on November 5, 1895.

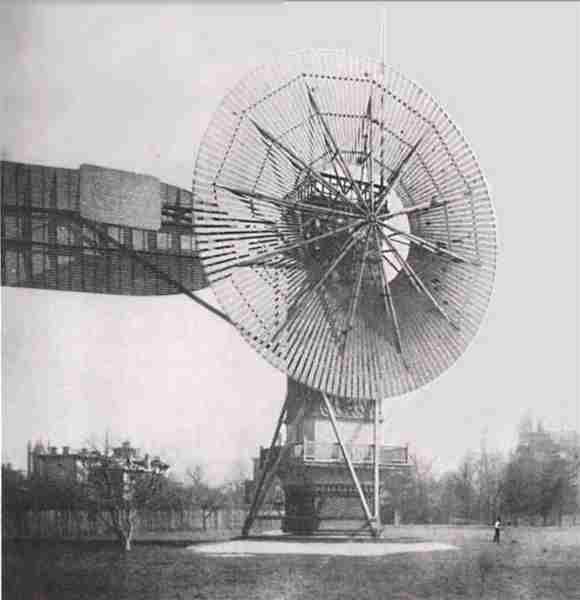

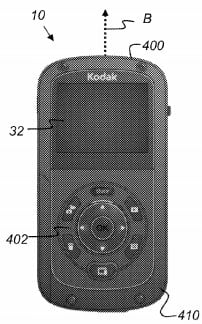

Yes, Virginia, there actually is an automobile patent – actually the automobile patent. George B. Selden of Clarkson, New York (near Rochester) was granted U.S. Patent No. 549,160 for a “Road Engine” on November 5, 1895. Inspired by the gasoline engine invented by George Brayton and introduced at the Centennial Exposition in Philadelphia in 1876, Selden went to work on an improved engine with an enclosed crankshaft that powered a four-wheel vehicle. He filed for the patent in 1879, but he then filed a series of amendments to his application, stretching out the process so it took 16 years to get his patent. Talk about patent pendency! In a strange twist of fate – you know we love them – George Selden’s witness when he filed his patent application was none other than George Eastman of Kodak Eastman fame. Small world.

Selden’s patent covered an internal combustion gasoline engine that powered a four-wheel vehicle. Pretty broad coverage. He began assembling automobiles in Rochester at his Selden Motor Vehicle Company. He worked out a deal with the Association of Licensed Automobile Manufacturers to pay him a 0.75% royalty on all cars sold by the association’s members.

All went well until one Henry Ford came along. What most people do not know is that Ford was actually late getting into the automobile business. By the time he introduced his Model T (he had worked his way through Models A through S) in 1908 there were at least 50 companies assembling automobiles and paying a royalty to the association. Almost all are now out of business, but Buick and Cadillac are two that survived.

Ford was not about to pay anyone a royalty! It would not have broken him or significantly raised the price of his cars, but the man who said you could have “any color you want as long as it’s black” just did not want to pay the royalty or even recognize the legitimacy of the Selden Patent!

Ford was not about to pay anyone a royalty! It would not have broken him or significantly raised the price of his cars, but the man who said you could have “any color you want as long as it’s black” just did not want to pay the royalty or even recognize the legitimacy of the Selden Patent! Selden sued Ford and four other car makers for infringement of his patent. It was the news story of the day, just as the Apple-Samsung smartphone patent lawsuit was 100 years later, and it generated thousands of pages of documentation at a time when there were no copiers! Ford lost in the first round, but he appealed the decision and got the patent invalidated – a strategy still in use 100 years later – with his claim that Selden’s patent was not actually based on the Brayton engine but on an engine invented by Nicolaus Otto.

Ford went to become a multi-millionaire. Selden had collected a few hundred thousand in royalties, and he did manufacturer and sell a few cars – and later trucks – but he was a broken man after his patent was invalidated.

So What Exactly Is a Blockchain?

Posted: 6/24/2019

Blockchains can be public or private in terms of who gets to view the data. Because all transactions on a public blockchain are visible, anyone can view them and this enables the community of users of a given blockchain the opportunity to hold all users accountable. It also removes the need for a third party to authenticate transactions or store sensitive information. It also provides users with greater autonomy to read, write and publicly participate within the blockchain.

A blockchain creates a decentralized database in which information is stored on many different computers. Structuring a blockchain database limits risk, increases data protection, and promotes the distribution of data. No one can delete information – accidentally or intentionally – since it is backed up at various locations. The cryptographic security a blockchain can provide is unmatched. The most common blockchain secure hash algorithm in use today is called SHA-256.

Another key feature of a blockchain is the immutability principle. Data within the blockchain is trustworthy because it cannot be changed. In a blockchain, hashing is used to integrate new incoming information into the current state of the blockchain. Each new block of information that is added is hashed and tied to the previous block. This creates a transparent, traceable chain and ensures that all entries to the chain are legitimate. In order for a block to be added to the chain, a recorded transaction must first be verified by all the systems that are “mining” on the blockchain.

First Generation Blockchain: Launched in 2009, Bitcoin was the first widely used blockchain network and it set the stage for future blockchains and robust shared public ledgers. Transactions over this network are slow, taking about 10-15 minutes to complete. Although it is still the most famous blockchain network, it is well on its way to obsolescence.

Second Generation Blockchain: The next generation of blockchains were able to function as digital ecosystems or platforms off which other applications can run. This greatly increased the range of functionality the blockchain could offer users. Second-generation blockchains use "smart contracts" - a set of instructions or logic that can be triggered by an event. These smart contracts led to ICOs (Initial Coin Offerings) that are used to raise money for a project or business. This marked a radical shift for the entire blockchain space opening a new pipeline for entrepreneurship and reshaping the venture capital marketplace. The velocity of investment in the space is faster than almost any other money-raising vehicle. For example the Bancor Foundation raised $153 million in a three-hour period.

Beyond applications like smart contracts, second-generation blockchains offer greatly increased transactional speeds of around 10-15 seconds per transaction. This - added to the asset liquidity of the blockchain - has made it much more appealing as a store of value for circulation.

Third Generation Blockchain: The Gen 3 blockchain focuses on increased readability and usability. By simplifying code, allowing for account recovery, and offering an overall lighter-weight operation, these blockchains are designed with an eye towards scalability and mainstream adoption.

Proof-of-work, the transaction verification system used on the primitive Bitcoin network, has been widely replaced with delegated-proof-of-stake verification with transaction speed rates up to 10,000 transactions per second. Large amounts of data can be stored and processed on these blockchains. They will be able to interact with each other, connecting different blockchains together, and making the use of blockchains more practical for businesses and individuals alike. This is referred to as “atomic swaps.” Transactions on these blockchains are considered digital legal agreements and they will be the underpinning of future commerce and business.

Proof-of-work, the transaction verification system used on the primitive Bitcoin network, has been widely replaced with delegated-proof-of-stake verification with transaction speed rates up to 10,000 transactions per second. Large amounts of data can be stored and processed on these blockchains. They will be able to interact with each other, connecting different blockchains together, and making the use of blockchains more practical for businesses and individuals alike. This is referred to as “atomic swaps.” Transactions on these blockchains are considered digital legal agreements and they will be the underpinning of future commerce and business.Blockchain technology has come a long way since the launch of the Bitcoin ten years ago. The blockchain has emerged from an unknown technological novelty into an asset with real value. The blockchain does not solve every problem and is still faces growing pains as any immature technology does. As it continues to develop and expand in both prominence and potential, it will become increasingly important to stay informed and in-the-know about all things blockchain. And about all the new patents that cover the latest blockchain technologies.

Our thanks to Steven Gillen for his contributions to this article. Steven produced a most informative video, a Blockchain Crash Course, that expands on what is covered in this article.

So What Exactly Is Heuristic?

Posted: 5/16/2019

We adore words because patents are – after all – words: Words that precisely describe an invention that is worthy of protection. And when we come across a particularly effective, but rarely used, word, we stop what we are doing and bask in the moment. One such word that we recently came across was “heuristic.”

We adore words because patents are – after all – words: Words that precisely describe an invention that is worthy of protection. And when we come across a particularly effective, but rarely used, word, we stop what we are doing and bask in the moment. One such word that we recently came across was “heuristic.”Heuristic comes from the Greek “heuriskein” that means to find or discover something. A heuristic technique is a approach to problem solving that employs a practical method that is sufficient to reach a goal. A heuristic approach is not optimal, perfect or logical – or even rational – but it gets you where you want to go.

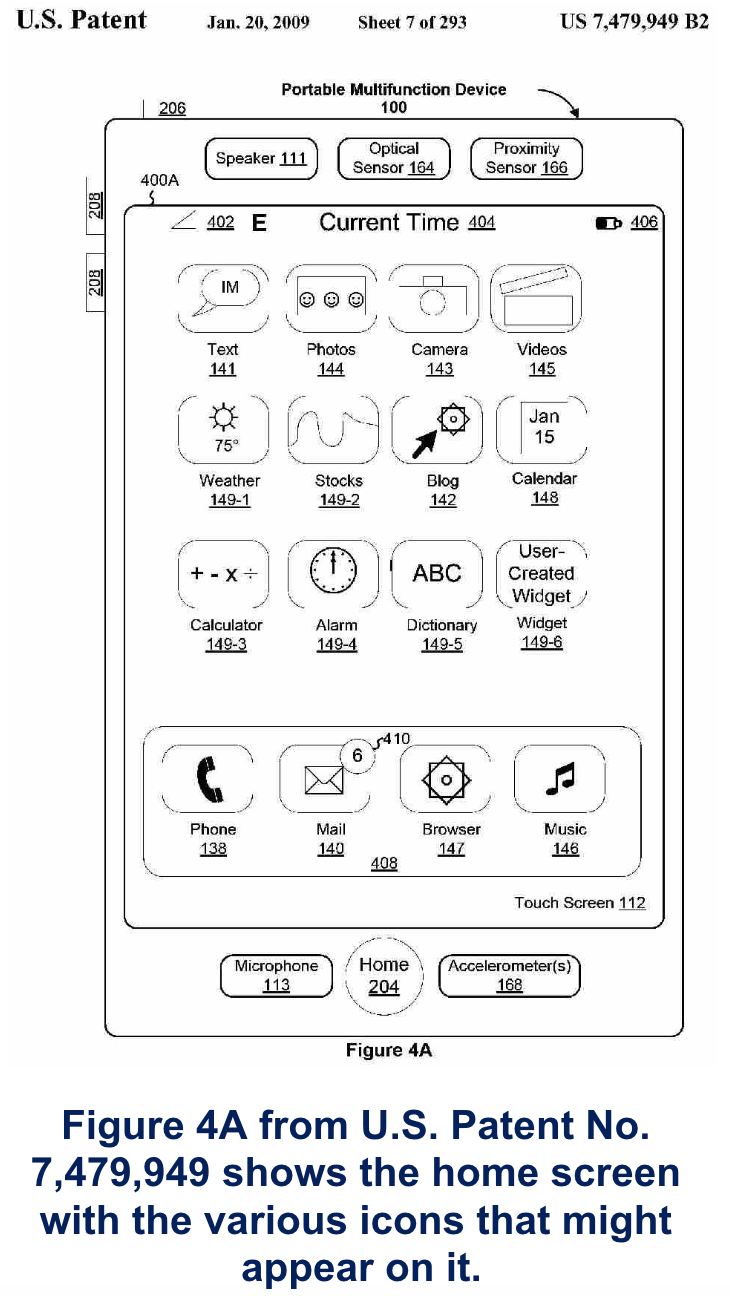

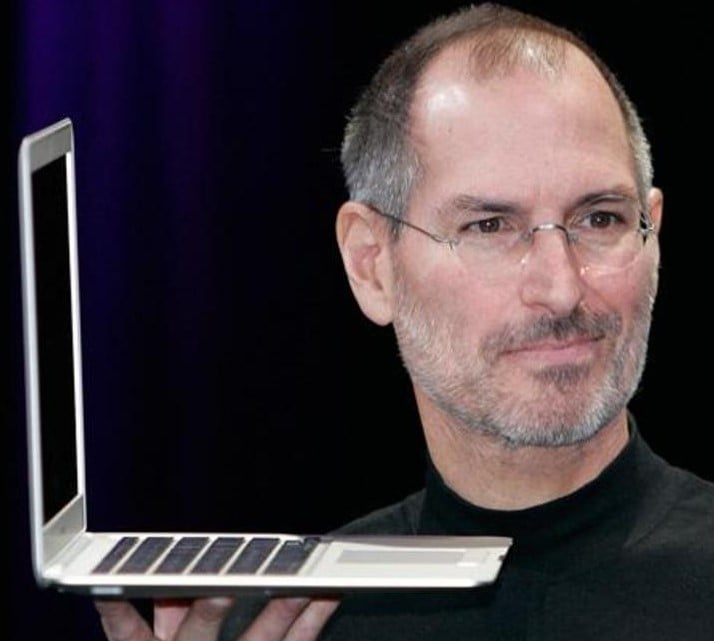

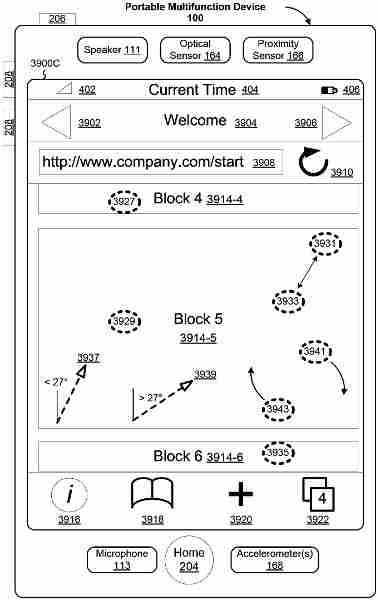

We were introduced to heuristics in one of the most famous patents of this century. You knew we had to tie this into a patent, right? The patent was granted in 2009 and it had 50 named inventors. The lead inventor was Steven P. Jobs. Got it yet? It was what is generally considered to be the iPhone patent, U.S. Patent No. 7,479,949 for a “Touch screen device, method, and graphical user interface for determining commands by applying heuristics.” The idea of applying heuristics – we can only assume as we were not directly involved with the writing of the patent – is that the icons on the screen could be figured out by the user without having to refer to a guide or manual, so that the user would fairly quickly figure out what each one meant and what it did. By touching each icon – that’s the practicality of heuristics – the user would gain an understanding – that’s the sufficient goal – of how to operate his or her iPhone.

The patent includes 20 Claims and hundreds of drawings to supplement all the words. The hard copy patent runs 364 pages! It is most comprehensive as you can see, covering most of the new features that turned cell phones into smartphones.

Talk about a foundational technology? This patent has almost 2,000 Forward Citations.

We Like Our Building(s) Better

Posted: 4/15/2019

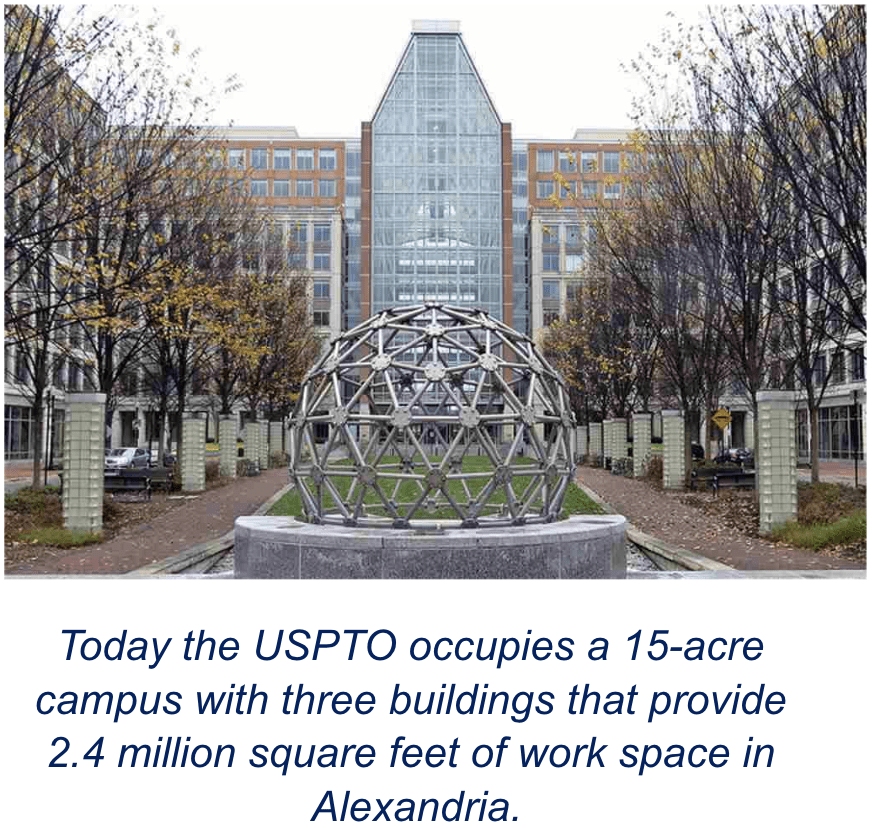

The Council on Tall Buildings and Urban Habitat (CTBUH) – no, we are NOT making this up – just named the new headquarters of the European Patent Office “Best Tall Building” for 2019. Just to be clear, it was not THE “Best Tall Building” in the world, it was just the “Best Tall Building” in the 100 to 199 meters category. To quality for this dubious award (as far as we are concerned), a building has to make significant contributions to the advancement of tall buildings and the urban environment, with sustainability as a key focus area. Each project is expected to minimize effects on the natural environment, have a positive influence on inhabitants in the local area, and be of economic vitality to its occupants and the community.

Award or no award, we like our Patent Office building better. Make that buildings. For those of you who have not been there, the U.S. Patent and Trademark Office has a spectacular campus with five buildings in Alexandria, Virginia, just south of DC. On your next trip to the District – business, pleasure or legal – take the drive down the beltway, or take Amtrak or the Metro, and see the place.

The Council on Tall Buildings and Urban Habitat (CTBUH) – no, we are NOT making this up – just named the new headquarters of the European Patent Office “Best Tall Building” for 2019. Just to be clear, it was not THE “Best Tall Building” in the world, it was just the “Best Tall Building” in the 100 to 199 meters category. To quality for this dubious award (as far as we are concerned), a building has to make significant contributions to the advancement of tall buildings and the urban environment, with sustainability as a key focus area. Each project is expected to minimize effects on the natural environment, have a positive influence on inhabitants in the local area, and be of economic vitality to its occupants and the community.

Award or no award, we like our Patent Office building better. Make that buildings. For those of you who have not been there, the U.S. Patent and Trademark Office has a spectacular campus with five buildings in Alexandria, Virginia, just south of DC. On your next trip to the District – business, pleasure or legal – take the drive down the beltway, or take Amtrak or the Metro, and see the place.

The buildings all face a spectacular courtyard, there is lots of glass, the atrium lobby of the Madison Building is very impressive, and – a factor to never be underestimated – there is lots of nearby parking.

Bring the kids, and take them to the National Inventors Hall of Fame and Museum. Tell them IPOfferings sent you, and you will get the special tour.

Is This the Next Ford Mustang?

Posted: 4/15/2019

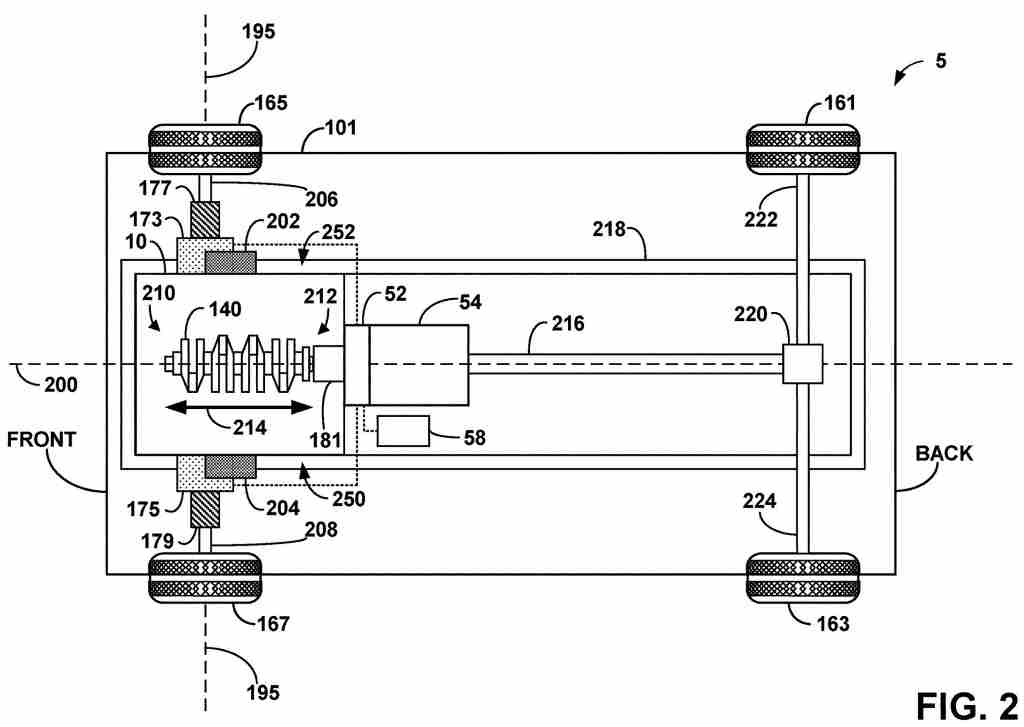

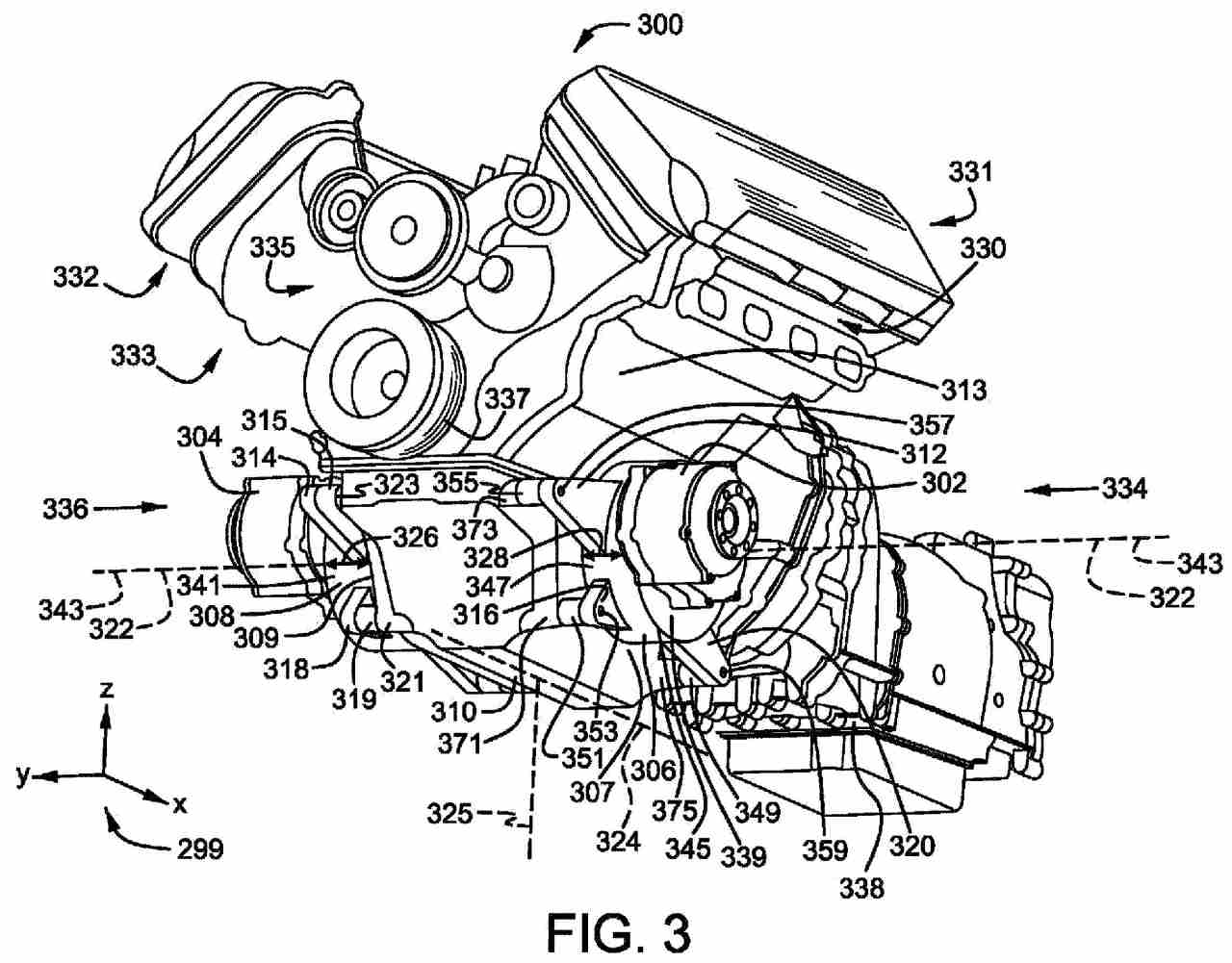

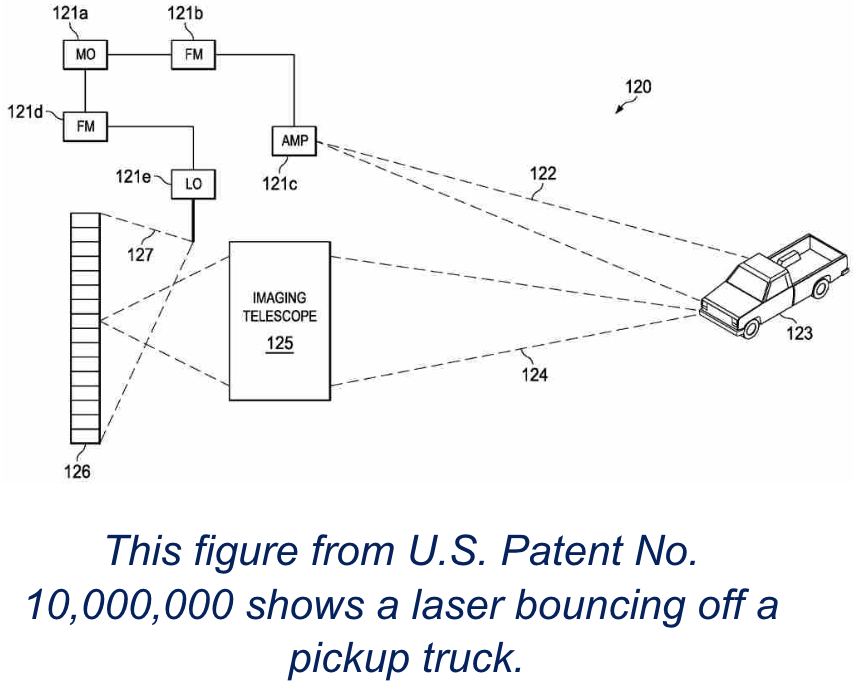

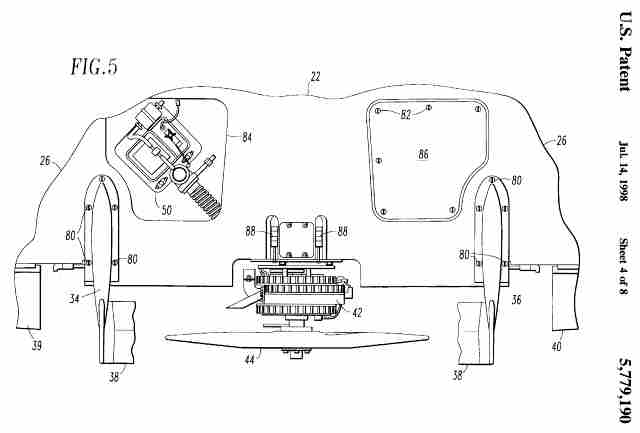

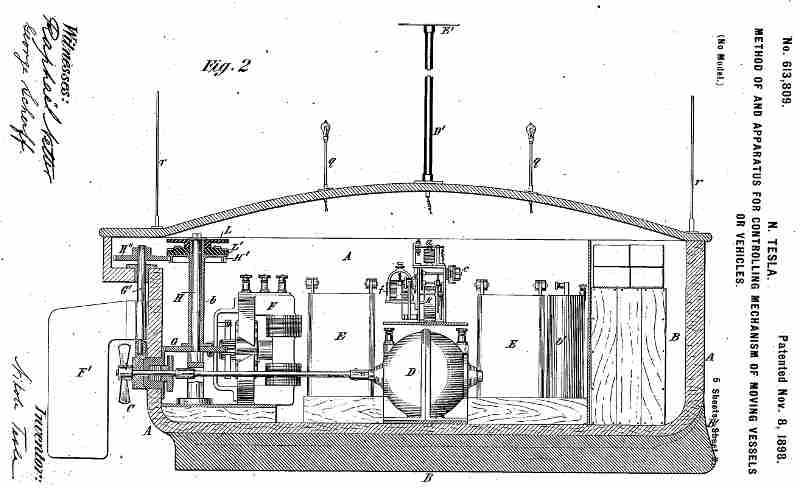

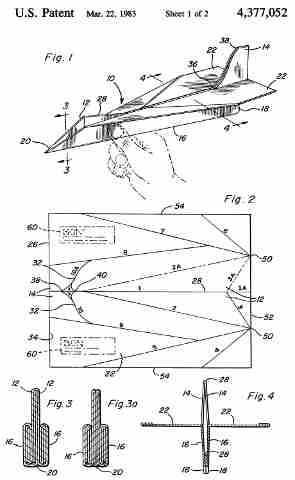

Yes, we are patent guys, but we are also car guys, so we love car patents. U.S. Patent Application 20190023115 filed by Ford for a “Twin motor drive system for hybrid electric vehicle” was just published, and it just might be the next Ford Mustang – a hybrid all-wheel drive car.

Yes, we are patent guys, but we are also car guys, so we love car patents. U.S. Patent Application 20190023115 filed by Ford for a “Twin motor drive system for hybrid electric vehicle” was just published, and it just might be the next Ford Mustang – a hybrid all-wheel drive car. It looks as if the vehicle will have traditional rear-wheel drive powered by its nasty gasoline engine, but it will have electric motors on the front wheels. We assume that the car will be rear-wheel drive when you are using the gas engine, but front-wheel drive when you switch to electric power. And then – and this is the really ingenious

part, but, hey, this is a patent, right? – you can kick in BOTH the gas power to the rear wheels AND electric power to the front wheels for all-wheel drive! The challenge, as we see it, is getting those two transmissions to work in sync so all four wheels are turning at the same rpms.

part, but, hey, this is a patent, right? – you can kick in BOTH the gas power to the rear wheels AND electric power to the front wheels for all-wheel drive! The challenge, as we see it, is getting those two transmissions to work in sync so all four wheels are turning at the same rpms.It also looks like Ford is not going to wimp out and downsize to a sissy six-cylinder power plant. Figure 2 from the drawing sure looks like a V8 engine block to us. Rrrrrr.

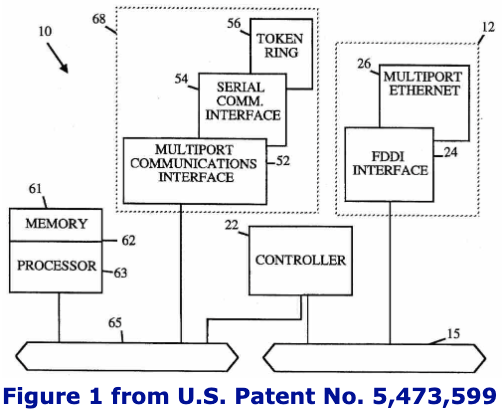

Cryptocurrency Patents Are HOT and Global!

Posted: 3/21/2019

Of greater interest than the total number of patents granted worldwide is where those patents were granted. The U.S. was NOT the leader in digital currency and/or blockchain patents in 2018. It was China that led the pack with 790 patents, while the U.S. was a close second, granting 762 patents in this category. Equally surprising was the No. 3 slot – South Korea with 161 patents issued – and the No. 4 spot – Australia with 136 patents. Canada and Indian tied for fifth place with 67 patents issued by each of those countries. The UK granted 36 digital currency and/or blockchain patents in 2018, followed by Singapore with 28 patents granted, and eighth place goes to Japan with 12 patents in this category. All other nations granted less than 10 patents in this area. France, Germany, Israel and Russia each issued just two digital currency and/or blockchain patents in 2018!

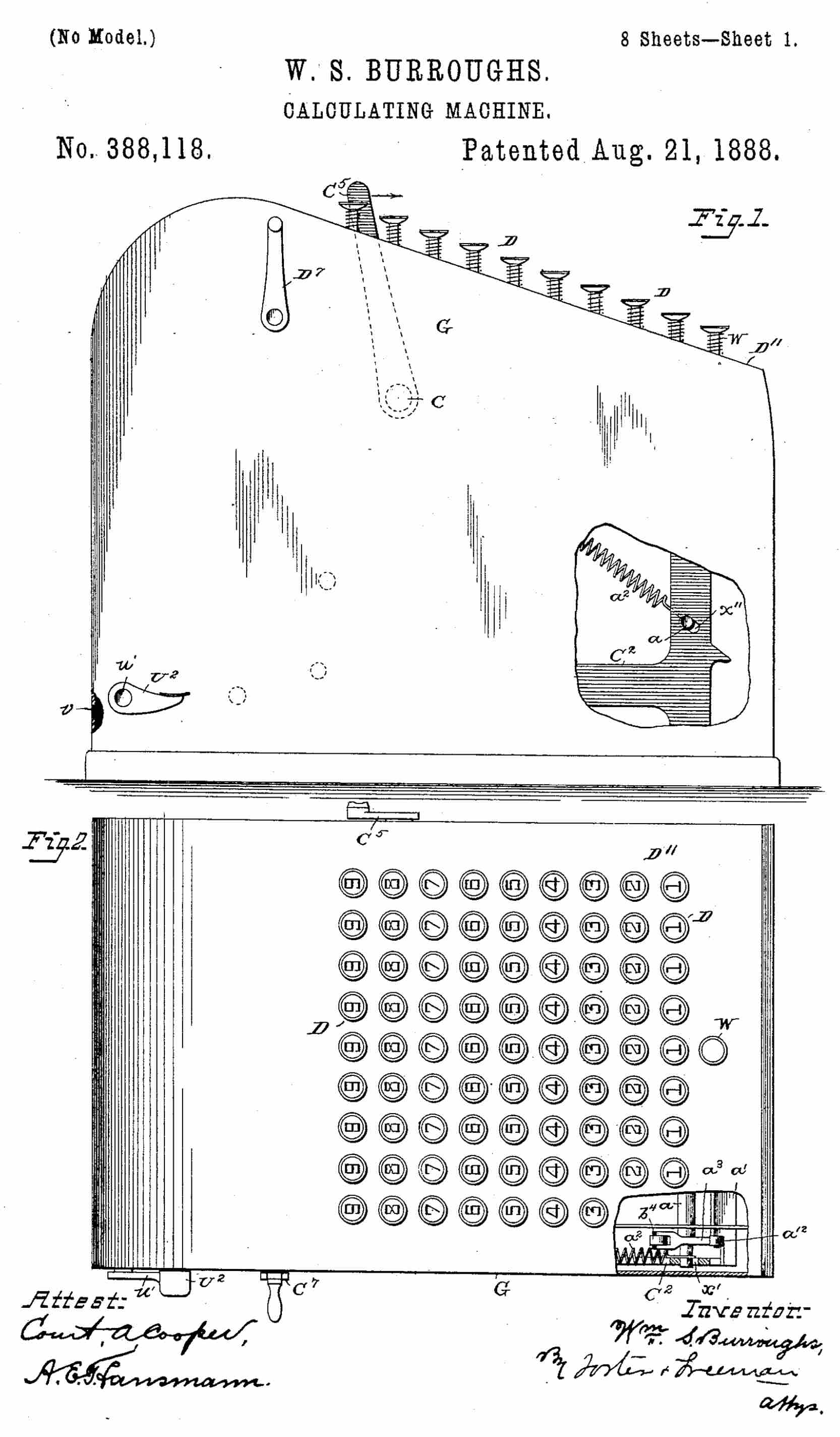

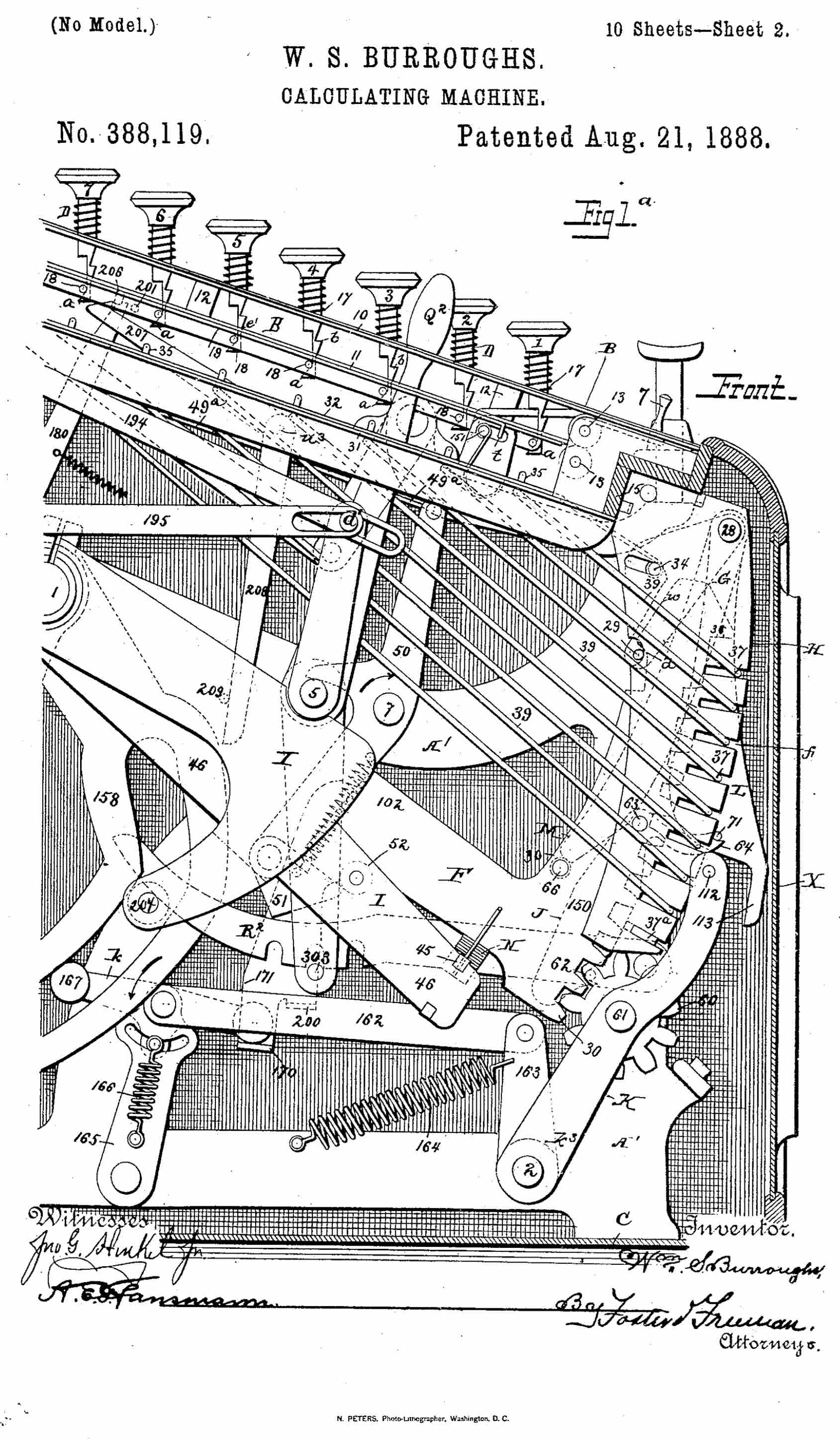

Readers of this column know that we cannot help but look back. Well, we did, and it appears that the first blockchain-related patent was granted way back in pre-Internet, pre-cell phone, pre-PC 1978 when IBM was granted U.S. Patent No. 4,074,066 for a “Message Verification and Transmission Error Detection by Block Chaining.” Go Big Blue! But we really have to ask if Team Armonk really knew what they had?

U.S. Ranks No. 2 in Patent Protection

Posted: 3/21/2019

The U.S. Chamber of Commerce Global Innovation Policy Center (GIPC) ranks countries each year in terms of the effectiveness of the protection of the patents they grant. In the GIPC rankings for 2018, the U.S. came in second with a rating of 7.5 (on a scale of 10.0). The number one ranking went to you-will-never-guess who. Go on, guess? Nope. Guess again. Nope. The top rating of 7.75 when to Singapore. Which you just learned from the previous article holds eighth place for the issuance of digital currency and/or blockchain patents. Singapore is also known as the country that punishes its criminals with public canings. We sure hope that applies to patent infringers!

The U.S. Chamber of Commerce Global Innovation Policy Center (GIPC) ranks countries each year in terms of the effectiveness of the protection of the patents they grant. In the GIPC rankings for 2018, the U.S. came in second with a rating of 7.5 (on a scale of 10.0). The number one ranking went to you-will-never-guess who. Go on, guess? Nope. Guess again. Nope. The top rating of 7.75 when to Singapore. Which you just learned from the previous article holds eighth place for the issuance of digital currency and/or blockchain patents. Singapore is also known as the country that punishes its criminals with public canings. We sure hope that applies to patent infringers!The U.S.’s number two ranking is not nearly as good as it sounds since the U.S. tied for second place with the UK, the Netherlands, Switzerland, Sweden, Spain, South Korea, Japan, Ireland, Germany and France! If we filter out the small countries, the U.S. ranked equally with the UK, Korea, Japan, Germany and France, but out-ranked Australia (a 6.25 rating), Canada (a 5.75 rating), and China that came in with a score of just 5.5.

The worst country for patent protection is almost not a surprise – Venezuela with a rating of just 0.75!

To learn how the Global Innovation Policy Center computes its rankings, you can read or download the report at the Global Innovation Policy Center website.

There Are Patents, and Then There Are Patents

Posted: 3/21/2019

Our request that the inventor or business secure a U.S. Patent is not because we are America-centric Americans running an America-centric business, but because the U.S. is the largest economy in the world, so a U.S. Patent has the greatest value and is the most salable of patents.

Our request that the inventor or business secure a U.S. Patent is not because we are America-centric Americans running an America-centric business, but because the U.S. is the largest economy in the world, so a U.S. Patent has the greatest value and is the most salable of patents.Here is what the holder of a Singapore (or drop in any other small nation) Patent has to realize. First of all, a patent is a bargain. It is a deal with the nation that issued it that in exchange for disclosure of the invention that nation will grant the patent holder exclusivity to his or her or its invention in that nation for a fixed period, most often 20 years. That means that your Singapore Patent is a public document that anyone in the world can access.

And that means that any business anywhere in the world can blatantly infringe your patent, and as long as they do not manufacture the product or sell the product in Singapore, there is NOTHING you can do about it. They can manufacture the product in the U.S., China, Israel or India, and sell it all over the world – except to the five million residents of Singapore or to any Singapore businesses - and the patent holder is helpless to do anything about it!

Additionally, if the infringer gets brazen, and sells the product in Singapore, it will not likely be financial viable to sue the infringer for infringement since any claim will be based on royalties on infringing products sold in Singapore, and Singapore – or Portugal or Mexico or South Africa – is just not a big enough economy to generate the tens of millions in sales that would be required to make patent infringement litigation worth the cost of filing and pursuing the lawsuit!

The sad reality is that if a company came across a really brilliant Portuguese or New Zealand patent, the smartest strategy would be to infringe the patent, and manufacture and sell a product based on that patent in every other nation on the face of the earth except where the patent was granted!

The four largest economies in the world today are the U.S., China, Japan and Germany. Get yourself patent coverage in those countries, and you will have a valuable, global IP asset. Take advantage of an EPO patent to get additional coverage in France (No. 6), the UK (No. 7) and Italy (No. 8), and you really have coverage.

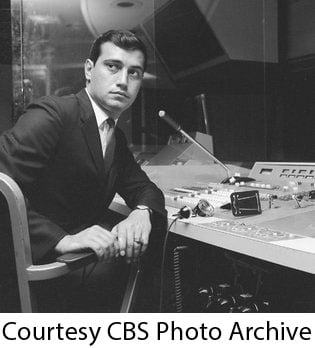

Who Is the Father of VoIP? How about Chester Gould?

Posted: 2/15/2019

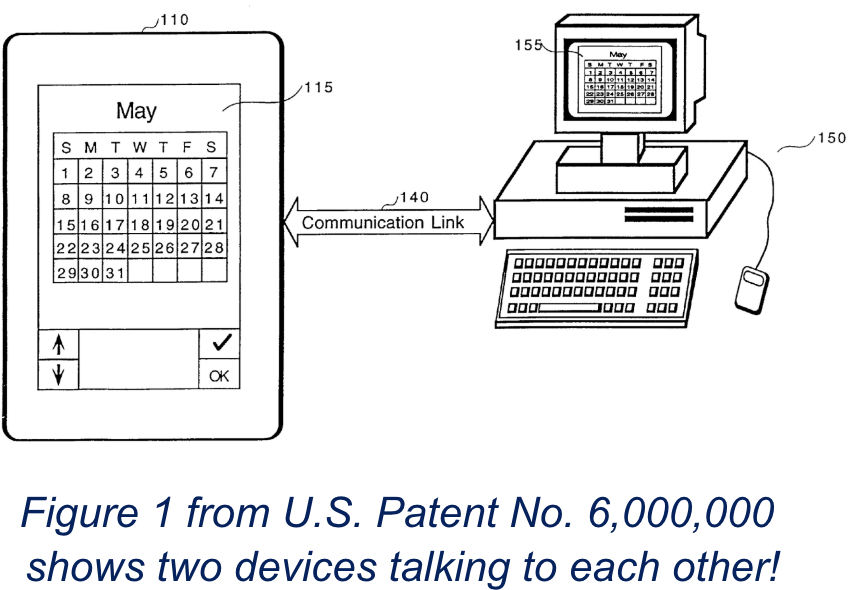

We feature in this month’s IP MarketPlace a patent that is foundational to Voice over IP (VoIP), the technology that makes sending voice and video and other messages from one person to another quick, easy, practical and affordable. As you will soon learn, the concept had a few starts and stops along the way.

We feature in this month’s IP MarketPlace a patent that is foundational to Voice over IP (VoIP), the technology that makes sending voice and video and other messages from one person to another quick, easy, practical and affordable. As you will soon learn, the concept had a few starts and stops along the way.It really goes back to 1931 when Chester Gould introduced the Dick Tracy comic strip. Detective Tracy was a tough, no-nonsense big city crime fighter who – very much like Batman – fought criminals with strange names and personas, like Flattop Jones and B.O. Plenty. Dick Tracy reached its height in American culture with a feature film based on the character that starred Warren Beatty as Dick Tracy and Madonna as Breathless Mahoney, a key witness to a murder. In 1946, Dick Tracy went high-tech with the introduction of his Wrist Radio, a miniature radio that Tracy wore on his wrist like a watch.

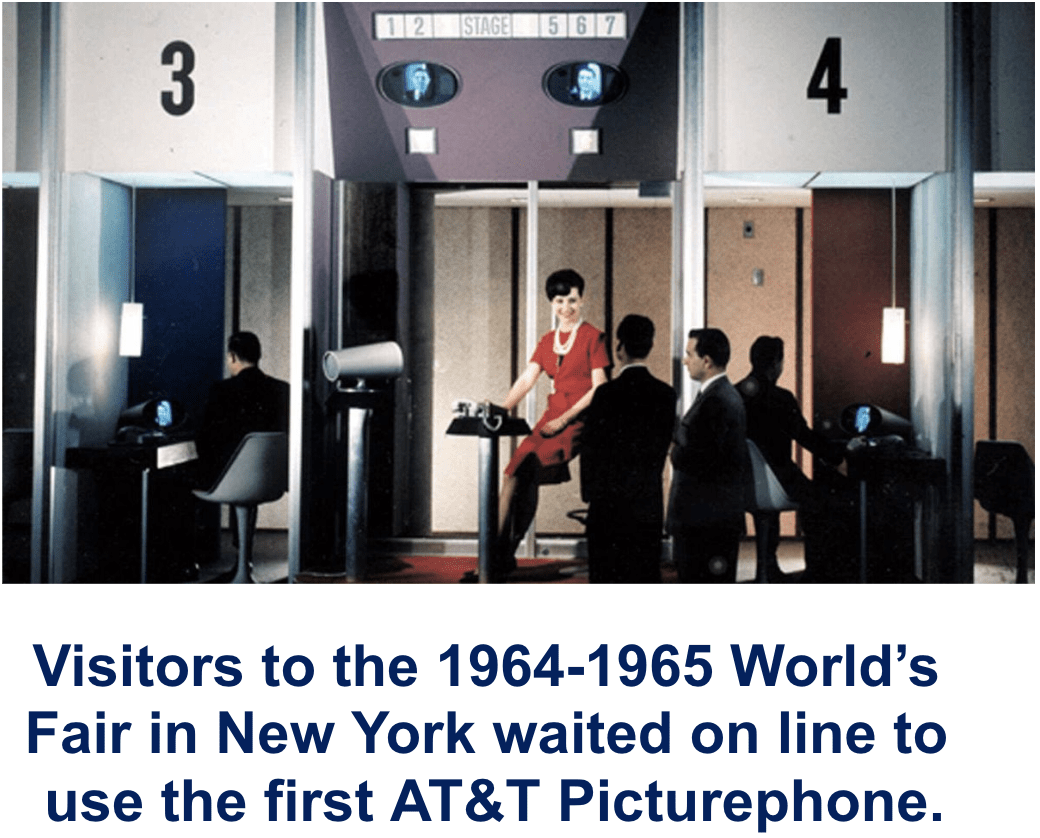

In 1964 – even though a Wrist Radio was still a figment of Chester Gould’s imagination and only existed in the Dick Tracy comic strip – the Wrist Radio was replaced with the Wrist Radio TV. Now Tracy could communicate both audibly and visually with police headquarters.

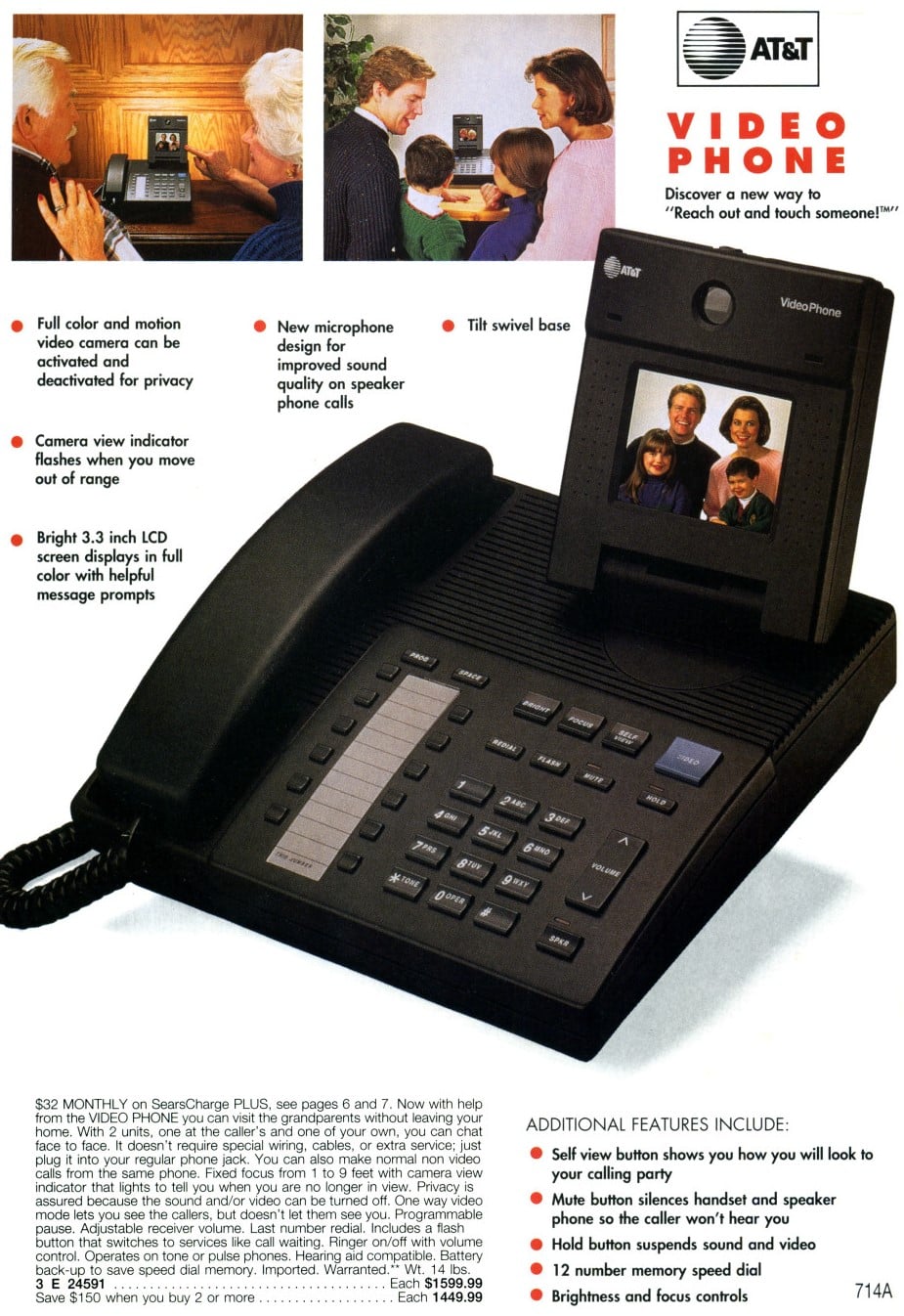

In 1964 – even though a Wrist Radio was still a figment of Chester Gould’s imagination and only existed in the Dick Tracy comic strip – the Wrist Radio was replaced with the Wrist Radio TV. Now Tracy could communicate both audibly and visually with police headquarters.Just to prove that great minds do think alike, the same year that Dick Tracy introduced his Wrist Radio TV, Ma Bell (what we called AT&T before it was broken up into operating companies) used the 1964 World’s Fair to introduce its Picturephone. It was called the “Mod 1” for “Model 1." Fairgoers in Queens, New York, waited on line at the Bell Telephone booth for an opportunity to communicate in voice and video with a complete stranger who was hooked up to a Mod 1 at Disneyland in Anaheim, California – on the other side of the continent! Users of the Picturephone Mod 1 got to talk to and see a black-and-white 30-frame-per-second image of the other person. Users were coached to stay perfectly motionless within a 16 x 21-inch frame to stay in view at the other end.

Using a Picturephone at that time costs $16 for three minutes. That’s $16 in 1964 dollars when gas was 25 cents a gallon. The Picturephone concept caught the attention of Stanley Kubrick who included one in 2001: A Space Odyssey. In the film, a Howard Johnson's on a space station included a Picturephone so space travelers could call home. The fact that the Picturephone was at a Howard Johnson’s appears now in retrospect as an eerily strange omen of things to come.

Using a Picturephone at that time costs $16 for three minutes. That’s $16 in 1964 dollars when gas was 25 cents a gallon. The Picturephone concept caught the attention of Stanley Kubrick who included one in 2001: A Space Odyssey. In the film, a Howard Johnson's on a space station included a Picturephone so space travelers could call home. The fact that the Picturephone was at a Howard Johnson’s appears now in retrospect as an eerily strange omen of things to come.Over the next 30 years, despite failure after failure, AT&T poured billions into its Picturephone concept. In 1969, AT&T introduced the Mod II. It featured a 251-line, 30 frame-per-second black-and-white image on a 5 x 5.5-inch screen. AT&T gave it the old corporate try, and attempted to sell it to businesses that would use it for meetings and conferences. It was not until 1971 that Ma Bell realized there was really no market for the Mod II and decided to cut its losses.

Well, not really. In 1992, AT&T re-launched the PicturePhone, but this times as the VideoPhone 2500. It had a small flip-up LCD screen that produced a grainy color image. It was introduced at $1,500 which was cut to $1,000 and then to $30 for an overnight rental. It took another two years for AT&T to finally and totally abandon the concept.

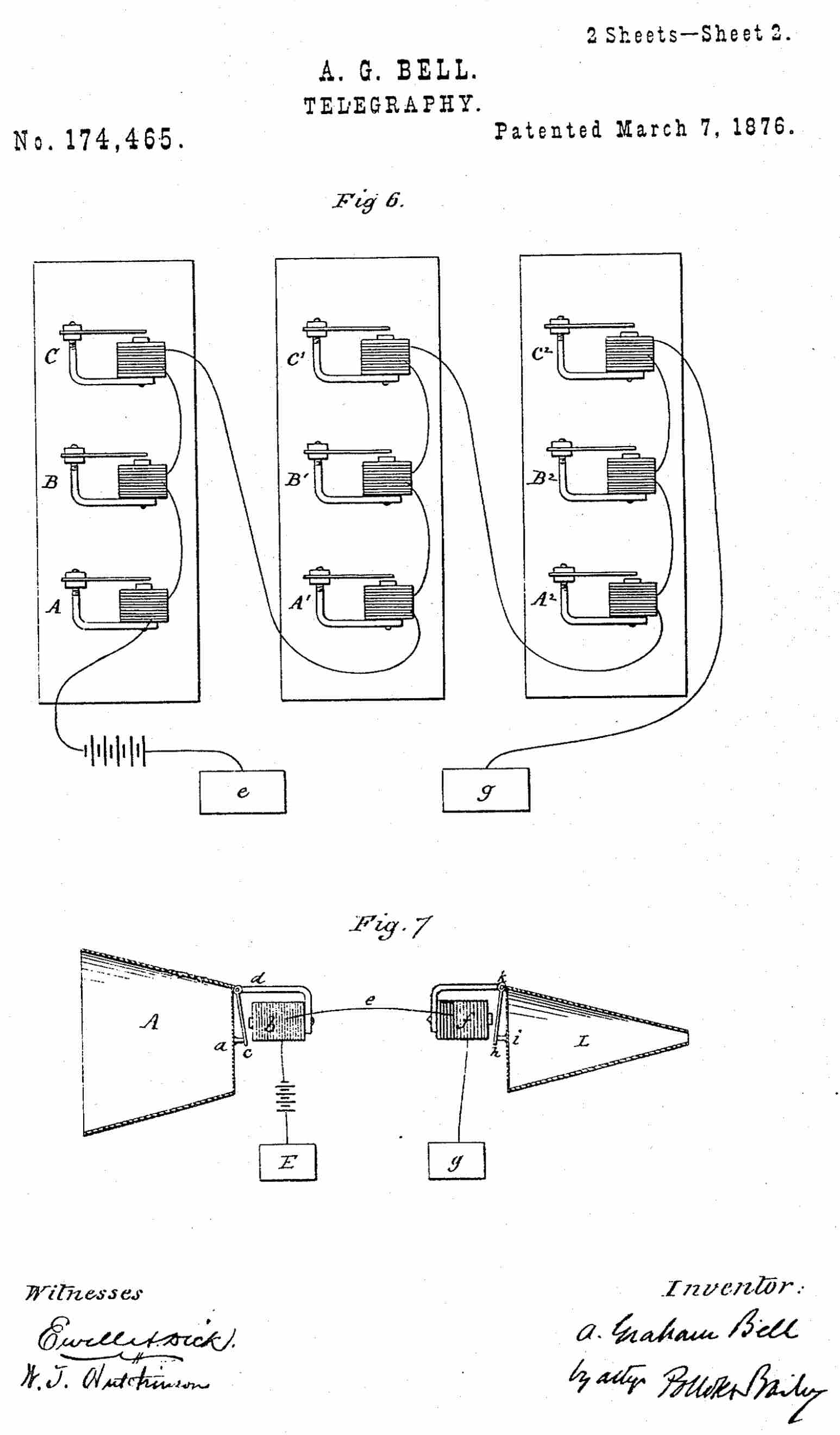

Today, Skype and Facetime and various other services do what the AT&T Picturephone and VideoPhone could not do What is the lesson? In our humble view of the world, while we have to credit AT&T for having the foresight to see the need for such a product, and the courage – or foolishness – to invest billions in the concept, the Picturephone and VideoPhone were doomed to fail from the beginning because they were conventional, landline, telephone-based products. Ma Bell attempted to get the concept to work over a single-copper-wire telephone system that had not changed significantly since Alexander Graham Bell received his telephone patent in 1876.

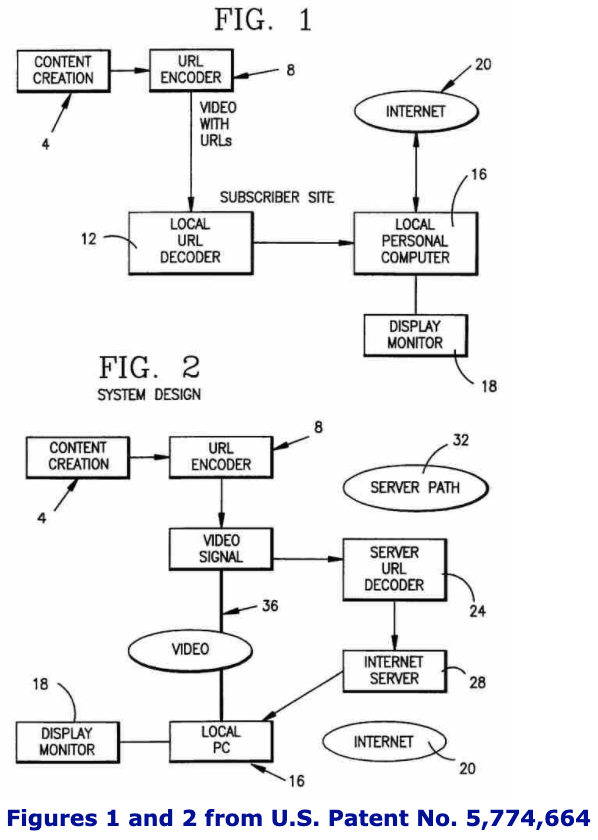

Today, Skype and Facetime and various other services do what the AT&T Picturephone and VideoPhone could not do What is the lesson? In our humble view of the world, while we have to credit AT&T for having the foresight to see the need for such a product, and the courage – or foolishness – to invest billions in the concept, the Picturephone and VideoPhone were doomed to fail from the beginning because they were conventional, landline, telephone-based products. Ma Bell attempted to get the concept to work over a single-copper-wire telephone system that had not changed significantly since Alexander Graham Bell received his telephone patent in 1876. In order for us to communicate with each other effectively and practically via both audio and video, we first needed the telecom revolution that produced PCs and laptops and the Internet and smart phones and WiFi and – most critical – the bandwidth to successfully transmit both audio and video signals back and forth between parties. U.S. Patent No. 7,852,831 for “Method and system for providing private virtual secure Voice over Internet Protocol communications” covers the foundational technology that makes Skype and Facetime and similar services possible. We needed the Internet to make this concept really work, and it came along just when we needed it!

Advice for All Inventors: How to Make Your Patents More Attractive and More Valuable!

Posted: 1/14/2019